"If we find the right energy policy, many other political problems will solve by themselves." - Amory B. Lovins

The energy transition is one of the most explosive topics of our time. The availability of energy in the desired form is the basis of modern society. The sudden loss of the heavily criticized oil alone, would have far more drastic consequences than both world wars combined. The failure of goods and human transport would result in hunger, disease and the collapse of all important systems for our society, such as the shutdown of industry and production. On the other hand, climate change will snatch away the livelihoods of hundreds of millions over the next ten years and lead to huge flows of refugees if effective measures are not taken and implemented. Until the middle of the century, the forecast looks even worse. So a dilemma is emerging.

The advantage of a situation where there is an abyss to the right and left is, that the right path is clearly revealed. Now we have to hike along the ridge until the valley is reached. Daring maneuvers along the slope are irresponsible and can reach devastating proportions. While this is immediately apparent to common sense, political and financial rivalries lead to unreasonable behavior. Since the subject of energy is very closely linked with power and domination, the influence of states and their politics will always be omnipresent. The regional differences in the occurrence and consumption of the most important energy sources aggravate this situation significantly. In 2018, the USA, China and India were responsible for 70% of the increase in energy. But together they have less than 10% of the resources.

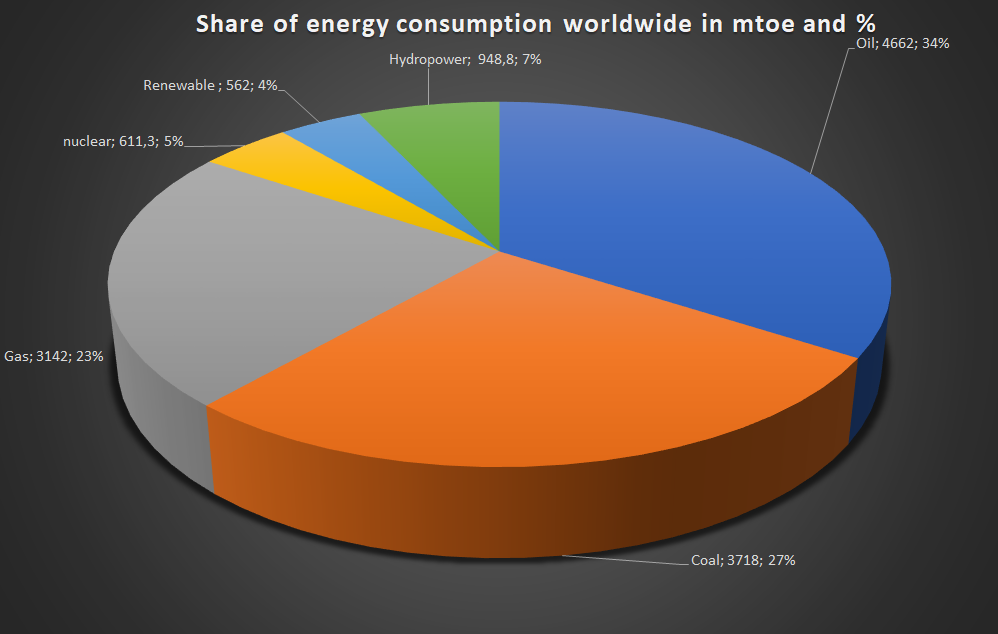

The global energy demand is steadily increasing not only due to population growth but also per capita. The energy requirement has almost doubled in the last thirty years. To illustrate, we indicate the daily world energy demand using various energy sources:

Oil: 40 million liters,

Coal: 57 million kg,

Wood: 120 million kg.

Such a huge demand for energy can only be satisfied with a combination of different energy sources. A complete replacement of coal, nuclear, oil, solar or wind energy is extremely unlikely in the near future. There is something ominous about knowing that the entire progress of the past 200 years and the way of life associated with it, depends on the availability of such a large amount of energy. According to the BP Statistical Review of World Energy, more than 80% of this energy came from fossil fuels in 2019, the depletion of which is already in sight.

The all-clear is given by the fact, that a hundredfold of the world's energy needs is in the wind and several thousandfolds in solar energy, the use of which can be realized in an environmentally friendly way. It is all the more astonishing that these energy sources only represent around 1% of global energy production. These facts are probably the reason why 80% of the total investment in renewable energies flows into these two. Wind and solar energy will play an important role in the future. But in addition to renewable energies and fossil fuels, nuclear energy also has its hat in play. We now want to list the relevant energy generation methods and then look at the energy market and the strategies of the large oil companies. After a summary and conclusion, the most sensible way, the mountain ridge, is explained. Note: Even if we use the term energy generation, it means an energy conversion of one form of energy into another, since the generation of energy is not possible.

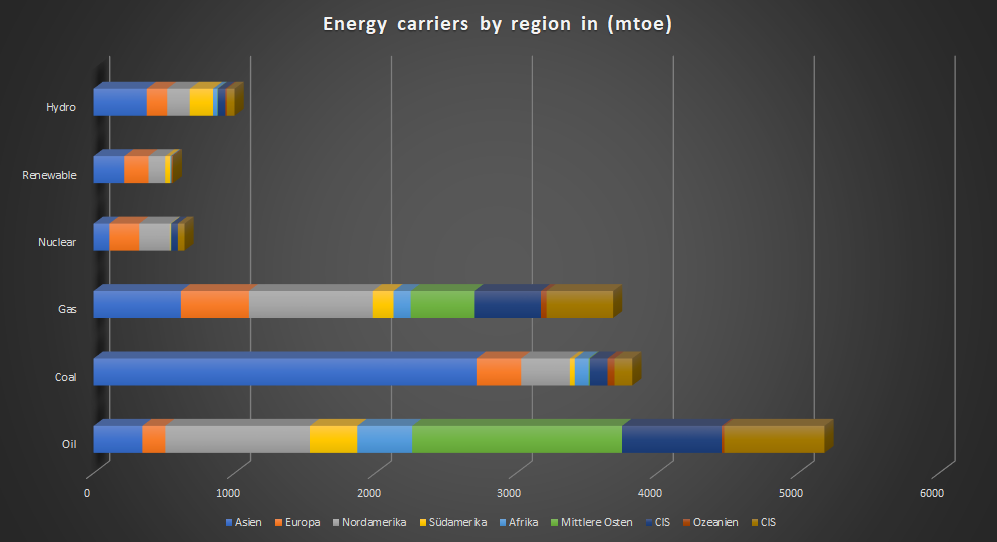

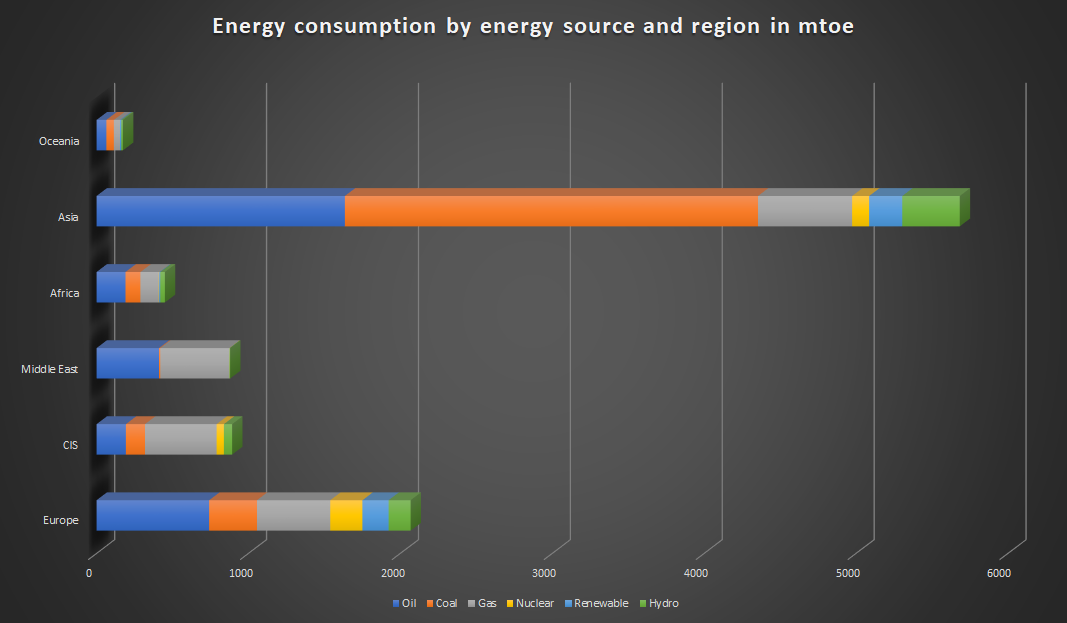

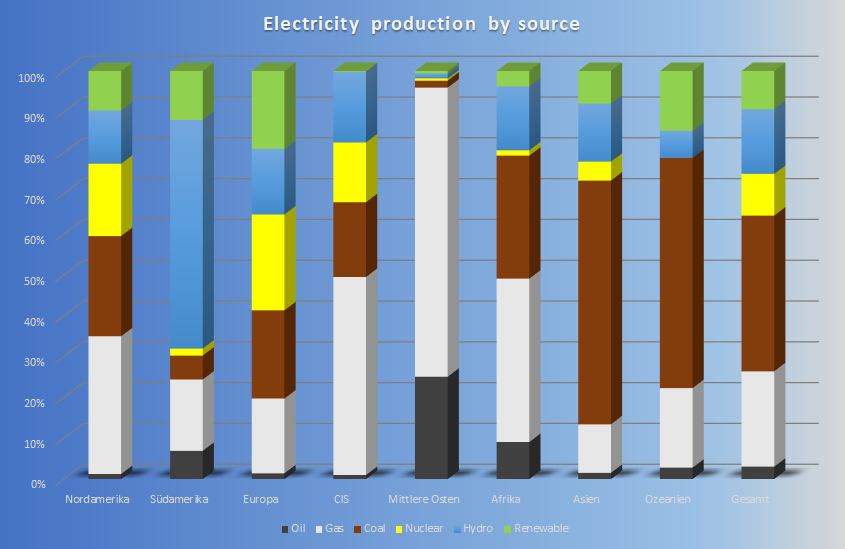

Now let's look at the production and the share of energy sources in total consumption by region. From a political point of view, it makes sense to divide the Asian region. In doing so, we kept to the usual breakdown in the energy sector (here especially BP statistical review full report) that the Middle East and the CIS states are considered separately from the rest of Asia.

In the two figures, the energy consumption is broken down by energy source and region. We will go into the individual aspects of these graphics for the respective energy sources later. At this point, only a few noticeable results should be noted. With almost 6000 million tons oil equivalent (mtoe), Asia consumes more than twice as much energy as the second-largest consumer, North America, with 2830 mtoe. The large total consumption of Asia (especially coal consumption) is not only due to the large population but also to the rising economies, especially China and India. In comparison, Africa has about a third of the population (Asia excluding CIS countries and the Middle East), but only a thirteenth (461 mtoe) of the energy consumption of Asia. The large proportion of fossil fuels and the low proportion of renewable energies are the reason for the energy debate worldwide. Now we want to look at the individual energy sources and proceed according to the size of the share in world energy consumption.

Petroleum (34%)

Today, as it was a hundred years ago, crude oil is the most important energy source in the world. It is used as fuel for land, air and sea transport, for heating living space, in industry, as raw material for petrochemicals, and in oil power plants for power generation (mostly used for peak consumption as it can be used quickly).

A major advantage of crude oil is its high energy density of around 11 kWh per liter. For comparison: the annual consumption of an electric oven with moderate use corresponds to the energy content of four liters of oil. For a medium-sized refrigerator, this is about 12 liters. A four person household in Germany consumes an average of 4500 kWh, which corresponds to the energy content of 410 liters of heating oil. At a liter price of 0.53 euros, that makes 220 euros electricity costs per year. In comparison, at today's electricity prices of € 0.27 per kWh, households pay € 1,215 per year. The efficiency, which plays a decisive role in conversion into electrical energy, was deliberately neglected, as this was only intended to help understand the energy density of petroleum. But even with poor efficiencies of 30% percent, the use of oil in the household would cut electricity costs in half.

However, it is obvious why this is still not a good idea. Greenhouse gases, harmful substances and limited resources are forcing mankind to abandon an energy source that has highly developed application technologies. This phase-out will be a long time coming, as it takes decades to replace so much energy with environmentally friendly and economical energy sources.

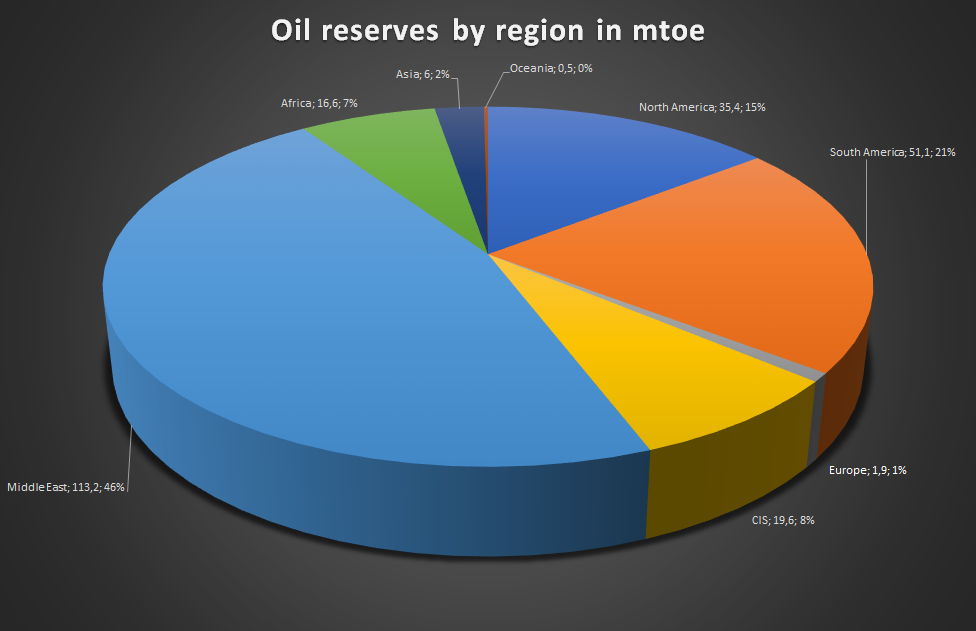

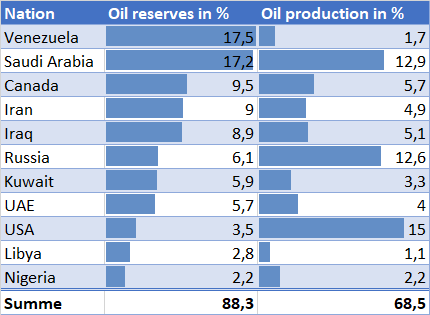

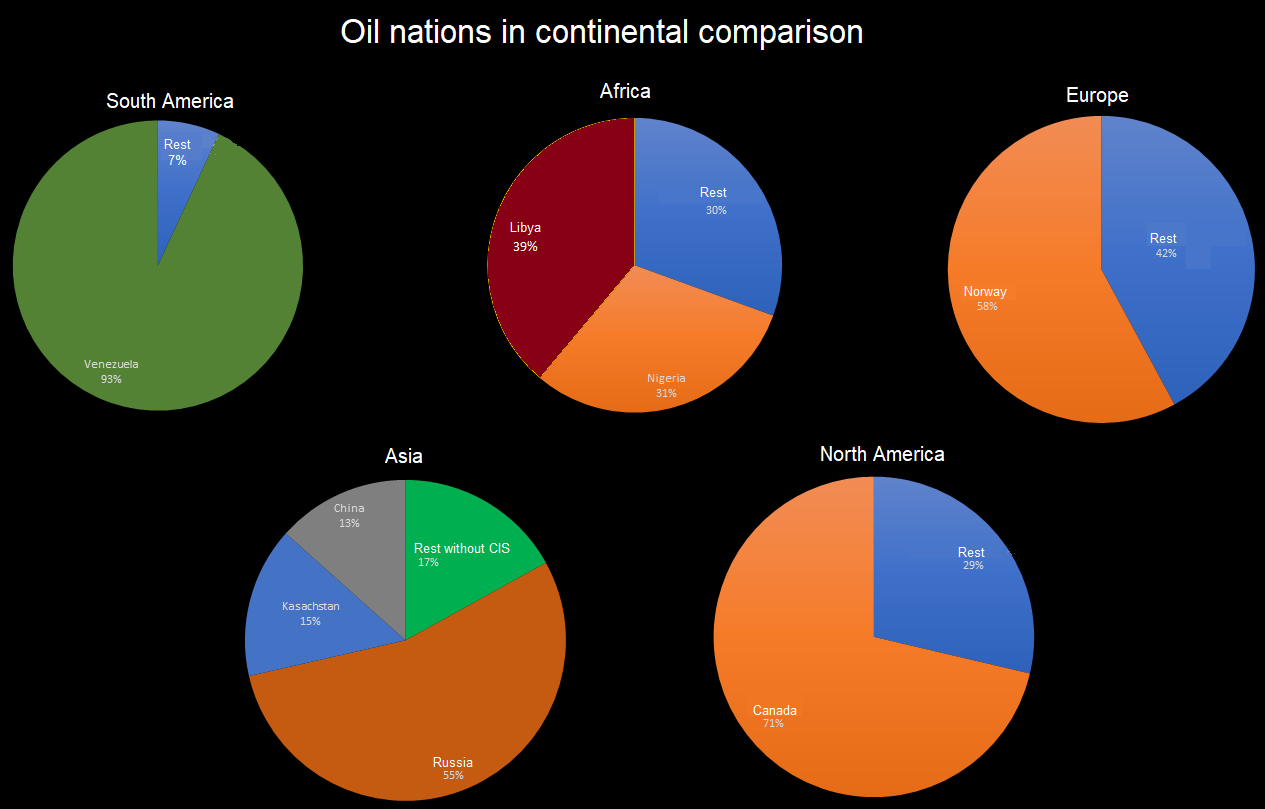

Let's look at the distribution of oil consumption, oil production and oil reserves by region. It can be seen that South America and the Middle East have a lower share of production than their share of global reserves. North America and CIS countries, on the other hand, produce more percentage-wise than they have reserves. In a precise country comparison, the discrepancies become even clearer. Saudi Arabia and Venezuela together own more than a third of the oil reserves.

While the oil-richest country Venezuela, which owns 17.5% of the world’s oil reserves, only contributes 1.7% to worldwide oil production, the US has a 15% share of world oil production but only 3.5% of the world's oil reserves. This aggressive approach by the USA since the discovery of fracking, a particularly environmentally unfriendly method of extracting oil from shale stone (so-called shale oil), has additionally stimulated the oil market. Certainly, the intention of being independent of oil exports has other politically motivated goals as well. Thus, the USA reduces the dependence of the oil price on Saudi Arabia and Russia and counteracts an alliance between both parties without his benevolence. How long this situation will last, given the high cost of fracking, is of course questionable. In addition, the reserves of 7,300 million tons known today, or 670 million tons with today's production, will already be used up in 2030. This also applies to Russia, with its daily production of 563 million tons and 14600 million tons of reserves, by 2040 it will no longer have any crude oil. In comparison, with its current production of 578 million tons with 41,000 million tons of reserves, Saudi Arabia can produce oil for another 70 years.

The lack of oil production in the country with the largest known oil reserves, Venezuela, is due, to the accessibility of the oil reserves and the necessary foreign help for equipment and know-how for its extraction. Since an additional powerful player means less influence for everyone, the most powerful nations in the world are trying to increase their influence in Venezuela in order to convert the threat from Venezuelan oil into their profit. For China, mining rights and a close partnership with Venezuela would be invaluable. However, enforcing an embargo on Venezuelan oil would be very easy for the US due to its military superiority in the Pacific Ocean. Relations with Panama also play an important role here and it has been a race for the two great powers to give up for many years. The unstabilizing of Venezuela can also be viewed from this perspective.

As the largest energy source, oil is particularly affected by political interests. Especially since the eight oil-richest nations own over 80% of the oil reserves. The same nations are responsible for half of the world's oil production (see table above). The only other nations outside this table with over 1% oil reserves are Kazakhstan (1.7%), Qatar (1.5%) and China (1.5%). In terms of oil production, it is Brazil (3%), Mexico (2.3%), Kazakhstan (2%), Norway 1.9%, Angola (1.7%) and Algeria (1.6%).

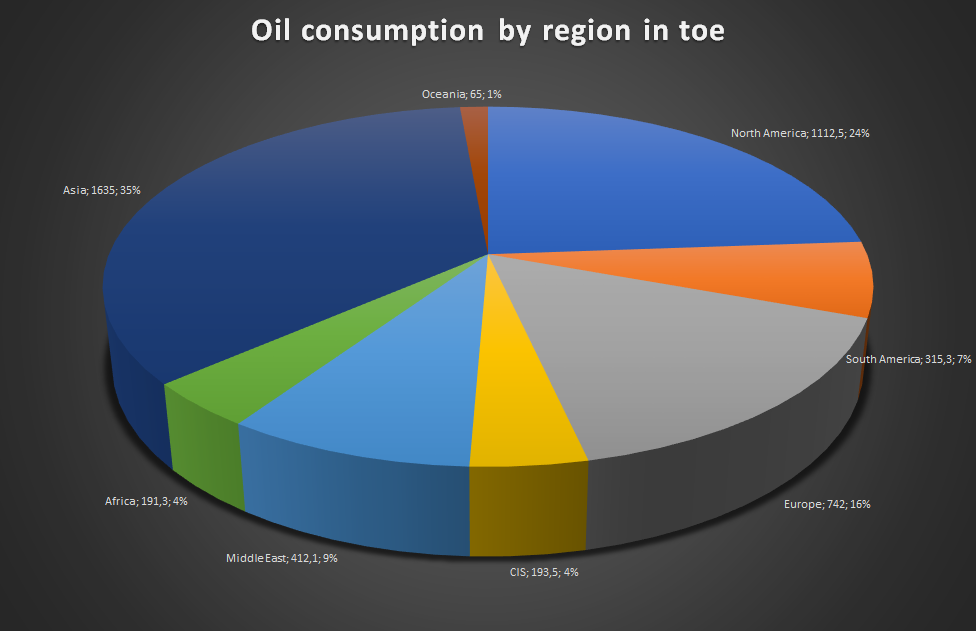

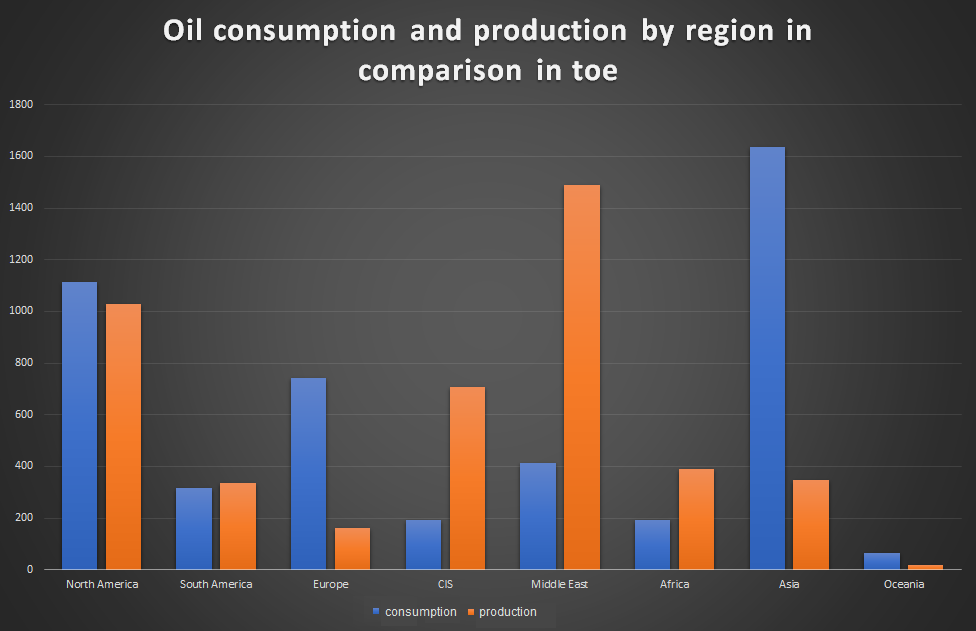

A significantly more homogeneous distribution can be seen in production than in reserves of oil. This is due, among other things, to the price at which the oil can be extracted. The most accessible and therefore most profitable oil is in the Middle East. Europe and Asia play only a subordinate role in terms of reserves and production. However, that changes when we look at oil consumption.

The comparison between oil production and oil consumption shows the dependence on oil as a source of energy or income. The most striking differences in this regard show the Middle East and the CIS countries, with a significantly smaller share of consumption. Africa also uses only about half of its production. Together with the much larger consumption of Europe and Asia than their production, an equilibrium is established.

The two oil importers, Asia and Europe can develop a good economic relationship with the Middle East, the CIS countries and Africa without needing North America. The figure to the right shows, that North America could act independently of the world market in oil matters. Import tariffs and legal regulations would be required, which restrict the free market economy, but would make the USA an oil-self-sufficient nation.

Another useful perspective is the regional view. It shows the local importance of the nations Venezuela, Norway, Nigeria, Libya, Canada and Russia.

Even if regional occurrences do not play a major role for the reference in the present, with the current rise of some nations, the wealth and the power structure will be more distributed, which brings a multi-polar world with it. The resulting competition will inevitably lead to greater profits for many developing countries, which will then experience an increasing need for energy and financial independence. Benefiting from the regional conditions and closing profitable deals with their neighboring countries, will be a result of this multipolarity. Under this aspect, the mentioned nations will gain more importance regionally.

The predictions about oil consumption vary from one another, but they all have one thing in common: consumption will grow over the next 15 years. The earliest projection for reaching the peak is in 2030, the latest in 2040. The forecasts of the companies with large oil reserves and little investment in renewable energies are at the end of the period and those of the energy companies with a large proportion of solar or wind at the beginning. The mean over 23 different forecasts made in 2018 and 2019 is in the year 2036. Even if the earliest projection were to be the case, it would take several decades to completely pull out of oil. With the introduction of electric vehicles, which are expected to dominate 15% of the market by 2030, BP predicts that from 2030 the largest consumer of oil will be the petrochemical industry, which uses oil as raw material.

Air traffic should not be neglected in this calculation. Electricity as a drive is inconceivable here. A small airplane consumes 2700 liters per hour, a medium-sized one 5500 liters and the largest 11500 liters. Even a small plane, such as a private jet, consumes more oil on a two-hour flight than a car consumes over 100,000 km. A long-haul flight from New York to Singapore with an A380 consumes almost 220,000 liters, which a car could cover over 4,000,000 km. Storing such immense amounts of energy in a battery seems utopian. If you take into account that there are around 46 million flights a year (the record number per day was over 225,000 flights on July 25, 2019), the question of the future fuel of air travel seems very important. A billion liters a day would have to be replaced by alternative energy sources. The most promising approach so far is the use of synthetic kerosene, the production of which has already succeeded in small quantities. However, the manufacturing process is very energy-intensive.

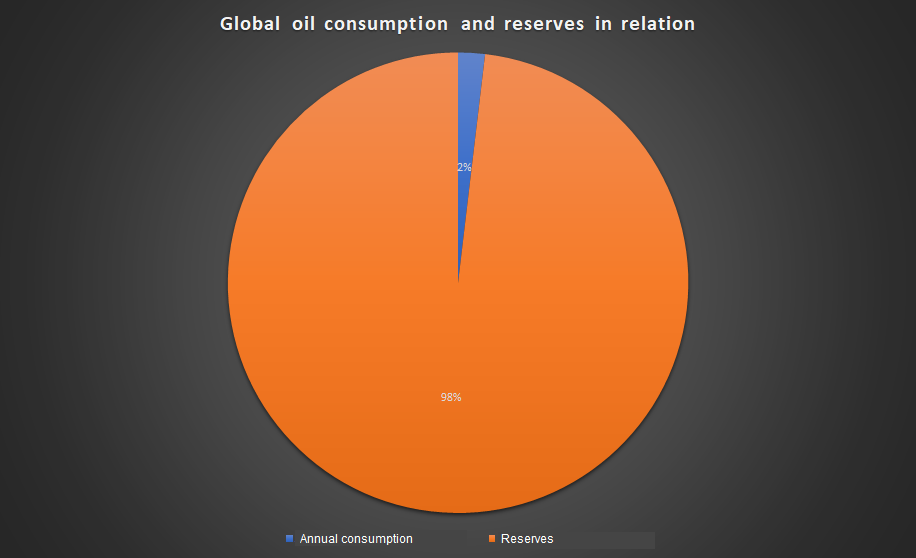

Shipping is also an important topic in this context. Since the fuel for ships is heavy oil, it is particularly rich in pollutants. The 15 largest ships emit as many pollutants as 750 million cars. The sulfur emissions are almost 100 times that of commercial air traffic. As a solution, the switch to LNG propulsion is currently being promoted. However, an exit from fossil fuels is not in sight for shipping. Approaches to developing drives with hydrogen or other shipping methods are still in their infancy. Regardless of which forecast is considered, a complete oil exit before the end of the reserves known today is extremely unlikely. Given today's consumption, these will last until 2070.

Even if the known oil reserves will last for about 50 years with today's consumption, the search for oil fields continues unabated. In 2012, Energy Watch Group researchers predicted a massive decline in oil production in the coming years. In addition, they claimed that the large oil fields have all been found. But from 2012 to 2019 oil production rose from almost 90,000 barrels a day to 100,000 barrels by 11% according to the IEA. Studies by BP, EXXON, and Bloomberg show similar results. Mexico announced in December 2019 that it had found the largest oil field in the last 30 years. In 2018, Bahrain discovered the largest oil field in its history. In the same year, the USA discovered one of the largest oil and gas reserves ever. In 2017 there was a low in the search for oil, in 2019 a four-year high, and the trend is rising. Many billions of euros were spent on search alone last year. The search for the black gold continues unhindered. Even if it contributes to the suffering of all of us: as long as there are consumers, there will always be producers, as long as stocks last!

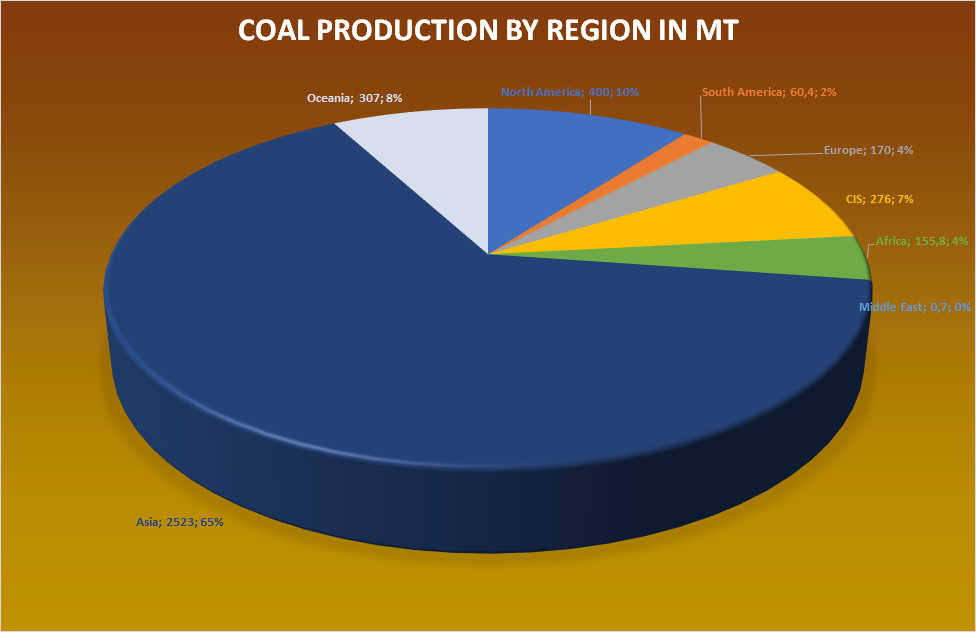

Coal (27%)

Coal is mainly used to generate electricity in power plants. It is the world's largest supplier of electricity and also the most environmentally harmful energy source. Highest CO² emissions, highest pollution in the air, destruction of the landscape due to mining, groundwater pollution and the destruction of huge areas. This is especially true for lignite. Nevertheless, it is strongly represented worldwide. With a 27% share in energy consumption, it is responsible for 33% of CO² emissions. The radioactivity of the waste product with 10,000 tons of uranium and 25,000 tons of thorium, as well as other radioactive substances such as radium or polonium in the ash, should not be neglected. According to some American and European scientists, the radioactive pollution from coal-fired power plants is many times that of nuclear power plants.

Generating energy from coal is thousands of years old. The generation of electrical energy by burning coal dates back to the 19th century. The first coal-fired power station opened in England immediately after the invention of the transistor, which enabled electricity to be used over long distances. No other energy source deserves extinction more than coal.

Unfortunately, coal-fired power plants are well represented around the world. For developing countries, in particular, they are one of the main sources of electricity. The advantage of coal is easy to access raw material and technology. As the oldest form of an industrial power plant, it is based on relatively simple principles.

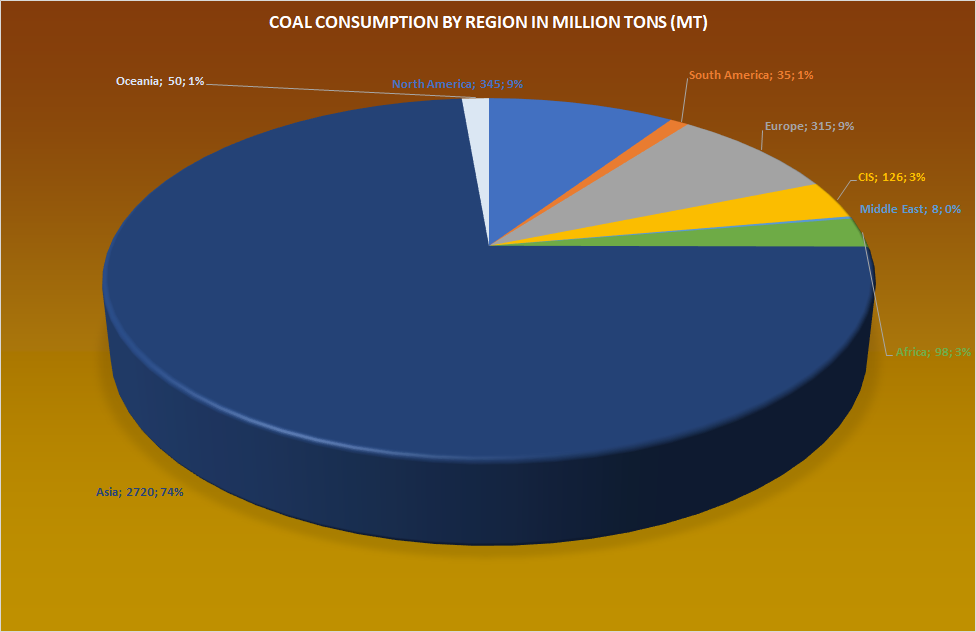

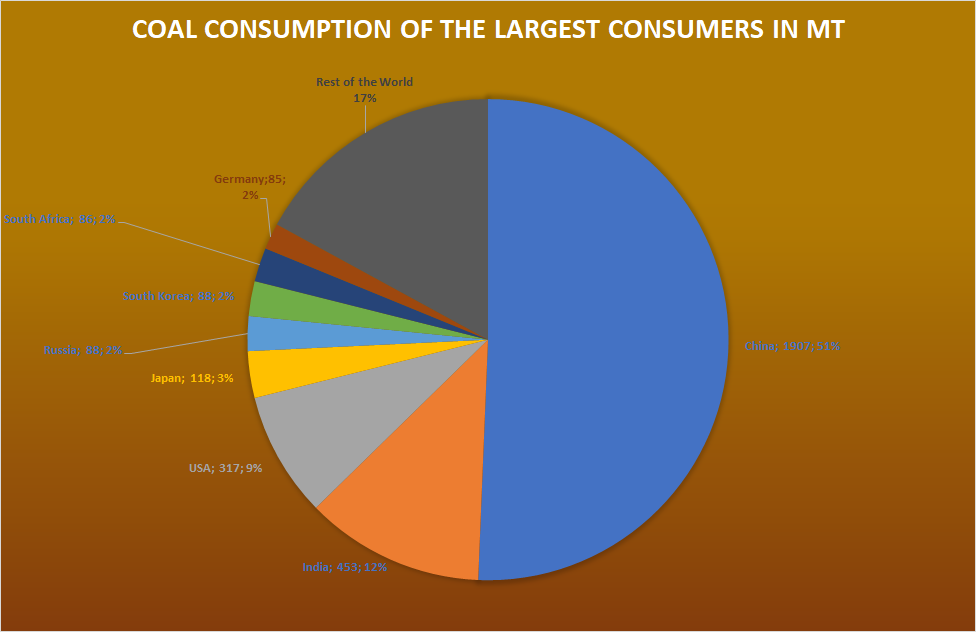

Storing the coal is also easy. However, the share of developing countries makes up little of total global consumption. It is the economically stronger nations of Asia that have very high coal consumption. A closer look reveals that only a handful of countries are responsible for the immense consumption of coal. The front runner China, for example, consumes over half of the world's coal consumption. Together with India and the USA, that makes up 70% of total global consumption. In China, almost 2 million people die every year as a result of air pollution. The emissions from coal-fired power plants are one of the main causes.

For producers, the following applies: as long as demand increases, supply will also increase! Until at some point, nature intervenes! That was the case in China in 2013. There was heavy smog in the northeast of the country, known as Harbin Smog. This incident highlighted the drastic consequences of the growing energy sector. In the cities affected, visibility was limited to 50m, fine dust levels went up to 1000ppm (today's limit value according to WHO is 20ppm). Since the smoke was indistinguishable from the ambient air, factories burned down without anyone noticing. Schools airports and even roads were closed. 600 million people were covered under a blanket of smog. Hospitals reported a sharp increase in respiratory illnesses. 2014 was the first year in many decades that China's coal consumption experienced a decline.

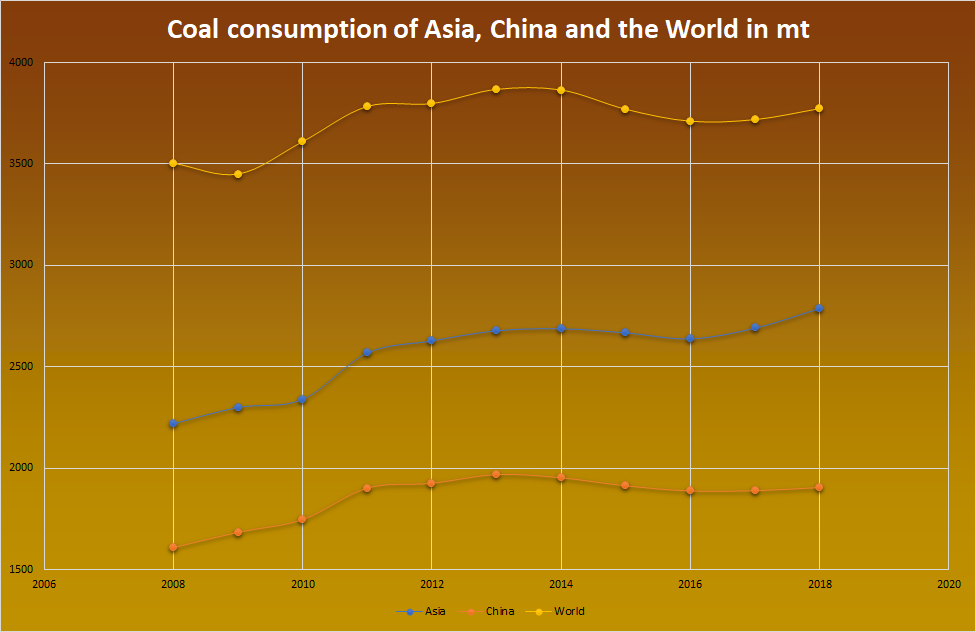

Unfortunately, the trend only lasted until 2017. But even during this time, total consumption in Asia rose. Consumption of India, the second-largest coal consumer, increased so much that it more than compensated for the Chinese reduction. The Asian increase from 2016 is also mainly at the expense of India. If you look at global coal consumption, the influence of Asia on total coal consumption can be seen from the almost parallel trend. The gobal decline in 2008 is due to the economic crisis.

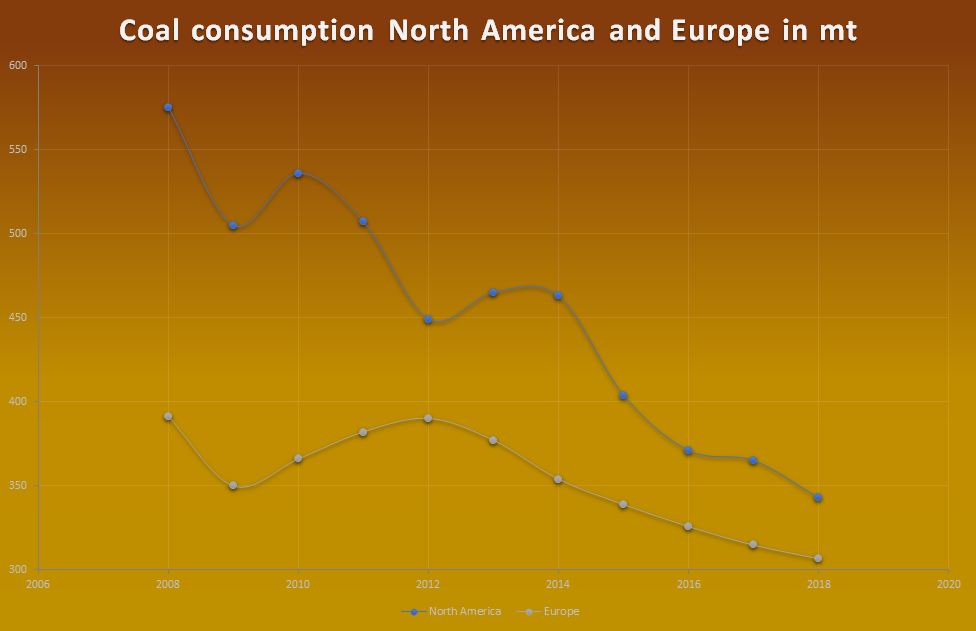

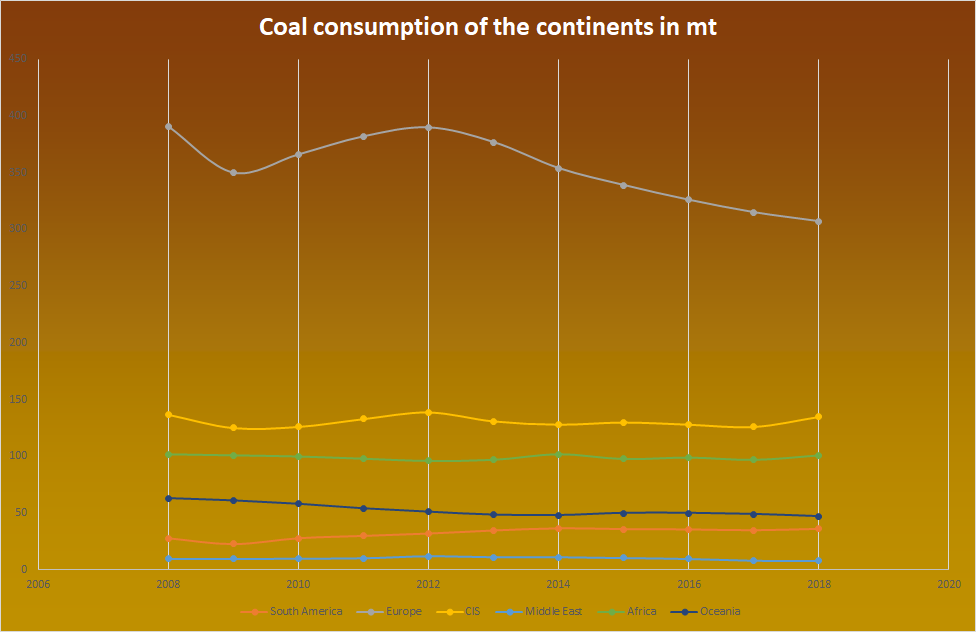

The Western World has reduced its coal consumption drastically in the past years. The course of the European curve has been falling steadily since 2012, while North America is subject to strong fluctuations, but is also characterized by a rapid decline. The curves of the other regions have their character. The CIS states show a fall from 2012 and a steeper slope again from 2017.

Africa peaked in 2014 after the smog crisis in China. Also for Africa a stronger increase can be seen from 2017. The coal consumption of South America rises steadily since 2009. But also here, there was a slight upward bend after 2017. With the lowest coal consumption, the Middle East shows a weak peak in 2012 and continues to decline very weakly until 2017, where hardly any reduction can be seen.

Fortunately the global upward trend did not hold. From 2019, less coal was used again im many regions. The increase in coal consumption over the past two years is due to the unusually high increase in energy demand and should not be interpreted as a renewed popularity of coal, since the increase in coal compared to the increase in energy consumption is small. The record in this discipline is set by natural gas. The consumption of coal is highly concentrated in a few countries. Three nations cause 70% of the total coal consumption, 8 nations 83%. The global coal procution will peak in 2026, according to Bloomberg. However, predictions of this nature are subject to major errors. At the end of 2012, the IEA predicted that coal would replace oil as the market leader and would rise rapidly. Less than a year later, demand fell sharply worldwide due to the smog disaster. This trend lasted until 2017.

Global CO² emissions would drop dramatically if these nations shut down their coal-fired power plants. South and Central America, the Middle East and Africa (excluding South Africa), together consume less coal than Germany. The largest lignite power plant in the world is in Poland, the second-largest in Germany (opened recently in 2012). The Federal Minister for the Environment called this opening an “outstanding contribution to the energy transition” and praised this inauguration as practiced environmental protection, since this enables the replacement of older, higher-emission power plants. But in reality, only two blocks of a nearby coal-fired power station have closed in return. The new coal-fired power plant, however, emits more CO² than the old one, roughly as much in relation to its output. After Bełchatów in Poland, these two power plants cause the second and third highest CO² emissions of all European power plants. Germany is one of the pioneers of the energy transition and CO² reduction in Europe, a region that is more environmentally conscious than any other region in the world. When the environment minister of such a country celebrates the opening of the second-largest climate offender in Europe as "practiced environmental protection", everyone can imagine how much influence politics will have on the business activities of large corporations.

However, the smog disaster in China has caused turmoil around the world and forced politics and the economy to redirect. There has been a decline in coal consumption in many countries around the world. That shows us, that it is the end-user, the population, who can influence the situation. In particular, because of the abundant occurrence of coal, everyone should show responsible behavior on this matter. From todays point of view, the world's coal reserves last far longer than crude oil. Experts assume a good 200 years.

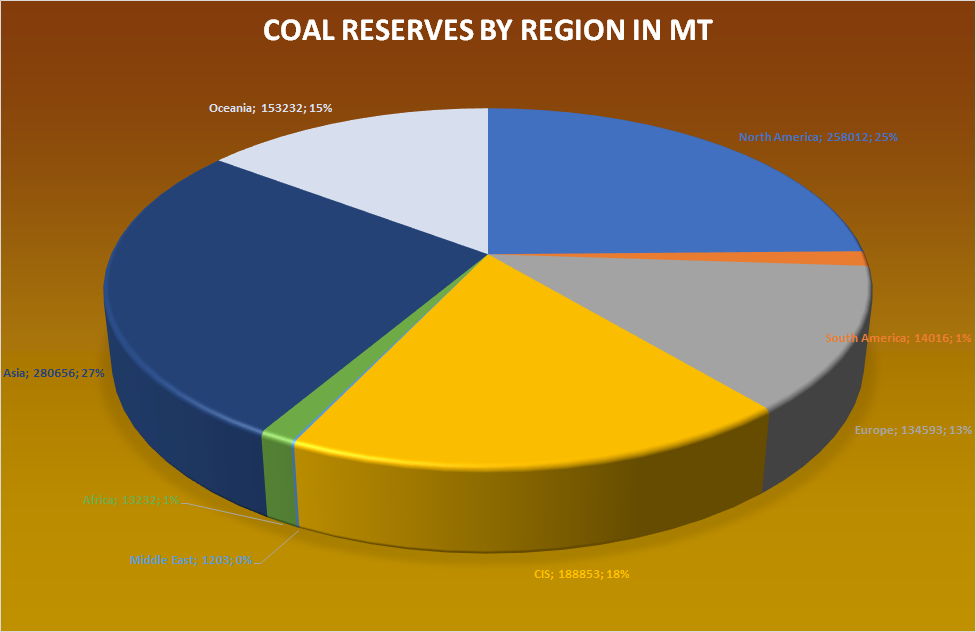

The advantage of coal over oil is its independence on imports. The consumption of each region is almost the same as its production. Since there is a lot of coal available, regions with few coal reserves still have enough to meet their own needs. South America, the Middle East and Africa have no relevant coal consumption.

With the exception of Colombia and South Africa, there is also no relevant mining. Australia and Indonesia export more than half of the world's total coal exports. As Europe's largest coal supplier, Russia is also a major coal exporter. Many developing countries rely on renewable energies, as most of them have good conditions e.g. solar energy, and these methods nowadays deliver electricity more cheaply than fossil fuels. Nevertheless, a slight increase in coal demand can also be seen in these countries.

The future of coal will be shaped by the behavior of China, India and the USA. The fact that China is not only the world leader in coal consumption but also the front runner in investments in renewable energies, can be interpreted as a sign of a reduction in coal production. But even if China is relying less on coal in its own country, it is building around 300 new power plants in other countries along the planned new Silk Road. India's coal industry is also constantly expanding with the world's largest coal company, Coal India. It appears that India will be the main driver of growth for the global coal economy for the next few decades. But India is also showing considerable investments in renewable energy, such as the largest solar system in the world that has recently been inaugurated. The US is rapidly replacing coal with natural gas. But falling gas prices could cause problems for the fracking industry, so that the USA could become more dependent on coal again. Despite many uncertain factors, various studies assume a stable consumption balance for coal by 2040, which would mean a percentage decline.

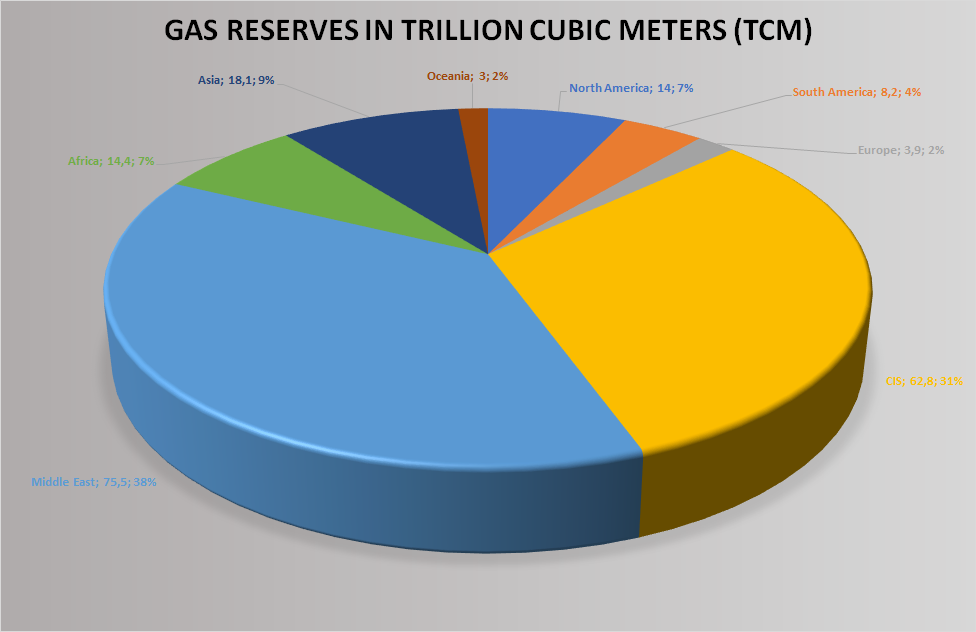

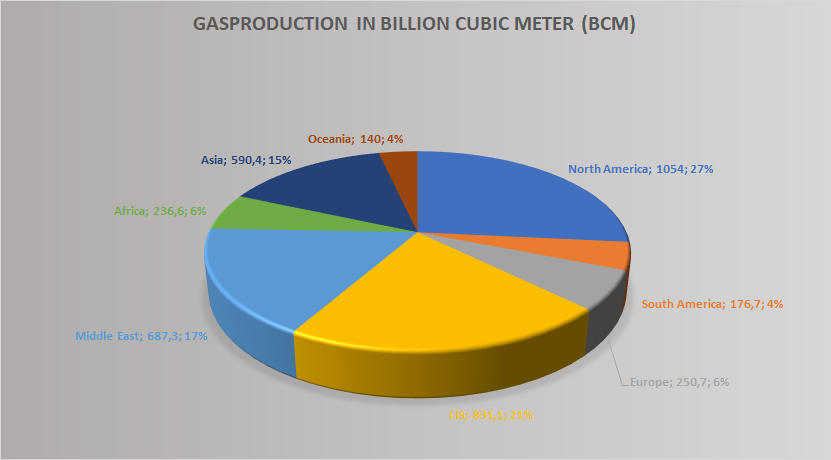

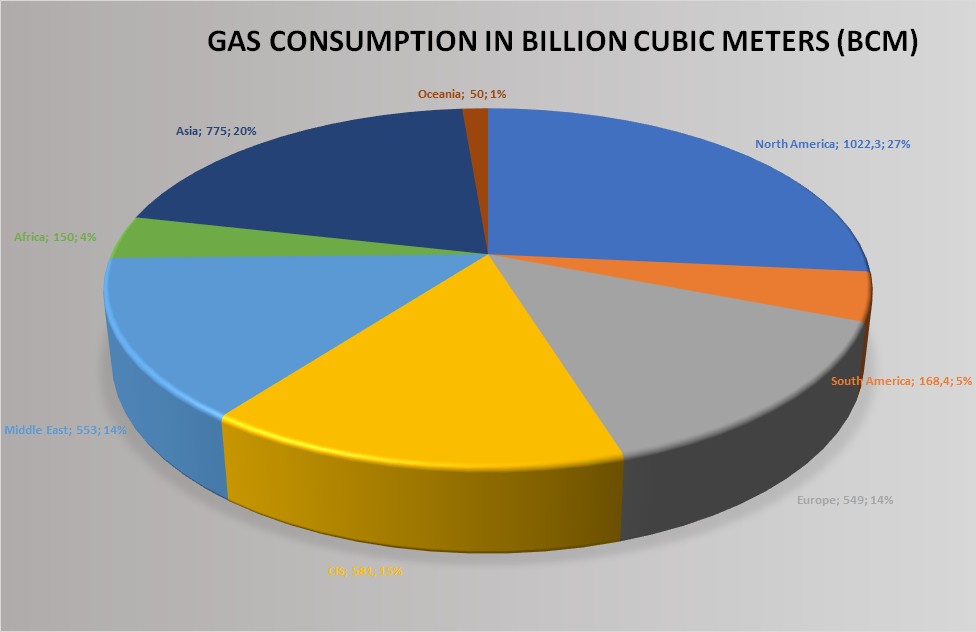

Natural gas (24%)

Heating represents the largest share of natural gas consumption. However, it is also used in power plants (peak load power plants) to generate electricity and also as fuel. Until the 1960s, natural gas was simply burned as a by-product in oil refineries in many places. Only the USA has been using natural gas industrially since the 19th century. In 1960, the share of natural gas in Germany was less than 1%. Today the share is 23%, worldwide it is 24%. The USA is the largest gas producer in the world, with a share of 27% in 2018. 11% more than in the previous year. The US uses the extracted gas mainly for domestic consumption. No other energy supplier is used as much as a substitute for coal as natural gas. The reserves will last for many years and new pipelines and gas-fired power plants are being built in many places. Following the trend of recent years, natural gas will have caught up with coal in a few years and will replace oil as the largest energy supplier before the middle of the century. In 2018, natural gas was responsible for 45% of the increase in global energy consumption. Developing countries in particular are experiencing a high increase in gas consumption.

The largest importers of natural gas are Europe and Asia, while the largest exporters are CIS countries and the Middle East (especially Qatar). The presence of a pipeline is critical for transportation. Russia, for example, only plays a subordinate role for Europe as a source of liquefied natural gas. In this genre, Qatar, Algeria and Nigeria are the main roles. However, around 40% of the pipeline gas in Europe and 55% in Germany is obtained from Russia. Together with oil and coal exports, Russia is Europe's most important energy supplier. There is a bilateral dependency between Europe and Russia. The export of gas represents one of the main sources of income of the Russian economy and the export to Europe represents almost 80% of the total gas export. Even if petroleum is currently a major source of income for Russia, natural gas will play a more important role in the country's future. While Russia has the largest gas reserves in the world, its oil reserves play a subordinate role. In order to be able to play along in the oil market, however, Russia produces a great deal of oil relative to its reserves.

Its long-term capacity in this regard is insufficient to remain a major player in the oil market. The next largest gas supplier in Europe is located within the European borders: Norway supplies around a quarter of European gas consumption. The EU had ambitious plans for gas from the Middle East: A pipeline from Qatar should go through Turkey to reduce Europe's dependence on Russia. But the Syrian crisis prevented this from happening. Meanwhile, tensions between Turkey and the EU in combination with the establishment of Turkish Stream (Russian gas that is transported via pipeline through Turkey), has decreased the likelyhood of Qatarian gas in Europe. Nevertheless, given today's volatile politics, that doesn't mean much.

As a gas giant, Qatar supplies many countries around the world and is the world's leading exporter of liquefied gas. The only pipeline from Qatar leads to the UAE, which, despite all the tensions, is the second-largest customer for natural gas from Qatar after South Korea. The data for Iran are surprising. Even the production is very high, there is only a very small export, mainly to Turkey. The domestic requirement is almost as high as that of China. In addition to Australia, also Malaysia and Qatar are important gas suppliers for the production centers of Asia: China, Japan and South Korea. The US imports gas mainly from Canada and Mexico through their respective pipelines but produces more than its domestic consumption.

Another point is the distinction between pipeline gas and liquid gas. LNG has a steeper increase in consumption as there is no need to install pipelines for export. However, this not only makes LNG export more flexible, but it also makes it more susceptible to fluctuations. As an example, consider the relationship between the UAE and Qatar. Although the bilateral relations of the two nations have reached an all-time low, trading in pipeline gas is still fully operational. Most scenarios suggest that by 2040 the US and Qatar will lead global LNG exports. But in the gas market, Russia will remain a very important player because of the existing and planned pipelines.

As a substitute for coal and the most sought-after heating fuel, gas will soon give up its role as the third most important supplier of energy and, over time, will become the world's largest supplier of energy, even before oil. LNG exports are growing faster than pipeline gas. The proliferation of renewable energies will primarily replace the consumption of coal and therefore develop secondary competition with natural gas. So far there is no relevant forecast that will reduce or stabilize the consumption of natural gas for the foreseeable future. In contrast to oil, gas is not threatened by electric vehicles since its main consumer is not the transportation sector. The spread of electric drives can even have a positive effect on gas consumption, since the expansion of a charging infrastructure will also result in the expansion of peak load power plants. There is no development so far, that would significantly slow down or stop the increase in gas consumption. To all apearances, the 21st century will be dominated by gas.

Biomass (9%)

Biomass is mainly used to generate electricity in power plants. Secondary applications are in heat production and as fuel. In the energy sector, biomass means plants, especially their fruits and vegetables. Since they can be grown in many parts of the world and also contain energy, they can serve as fuel for vehicles or energy storage for power plants.

Growing and using food for power plants takes getting used to, but has been spreading rapidly for two decades. So far, the share of biomass in the overall energy balance has increased faster than other renewable energies. Various types of grain are particularly productive and fast-growing, which shouldn't come as a surprise, since grain has been the main source of energy in human food for thousands of years. As organic matter, biomass has a similarly high level of CO² emissions as fossil fuels. The difference between the two energy sources in terms of their CO² pollution is due to age. This means that the CO² content that is emitted when burning biomass was taken from the atmosphere only recently when the plant was growing. This also applies to fossil fuels, but they took the CO² from another geological age a long time ago. In today's situation, it no longer matters where the fossil fuel CO² comes from, in contrast to biomass.

Biomass is particularly interesting for regions with low energy reserves, as it can be grown regionally. Especially for developing countries that have to spend a significant part of their GDP on energy imports, this form of energy generation is an important alternative. Short transport routes and safe storage are further advantages of regional biomass cultivation as an energy source. Since biomass power plants are not influenced by daily weather fluctuations like wind and solar energy, they are also suitable for base load use. A particularly valuable benefit is the use of leftovers and wastewater, the treatment of which would otherwise have cost a lot of energy.

On the other hand, the cultivation areas are limited worldwide anyway. Growing demand for them, while supply remains the same, increases food prices, which is particularly problematic for developing countries. The sharp rise in the price of grain, oils and dairy products between 2002 and 2008, which in some cases reached up to 500%, led to famine, riots and political unrest in 70 developing countries around the world. The use of cultivated areas for energy generation was one of the main reasons for this development.

A further reinforcing factor is that the energy yield is extremely low. Compared to photovoltaics, it takes a ten times larger area to grow biomass for the same amount of energy. It must be taken into account that solar energy has a low space efficiency under power plants anyway. Compared to nuclear power, it does much worse. To produce the same energy as the largest nuclear power plant in the world Kashiwazaki-Kariwa (plant area 4 km2 ), one would need a cultivation area the size of Thuringia. The entire area of Germany would not cover the domestic energy demand. Intensive agriculture with fertilization and pesticide application is used to increase the yield, which causes lasting damage to the soil and pollutes the groundwater. Currently, biomass is grown on an area of 2.4 million hectares in Germany, which is 20% of the arable land. With 185 GJ per hectare, that means 462 PJ, which is 3.5% of total German energy consumption.

Nevertheless, imports will become more important in the future because, unlike oil or gas, there are a large number of developing countries that could be considered for cheap cultivation. The already scarce supply of food in developing countries will be diminished by the rivalry with biofuels for industrialized nations and contribute to the suffering of the population. Unfortunately, as in the past with so many topics, that will not be an obstacle. As a result, the clearing of rainforests will increase. Another disadvantage of biomass cultivation is the threat to biodiversity. Dead organic material is important for many ecosystems. It improves soil quality and provides living space and food for many living things.

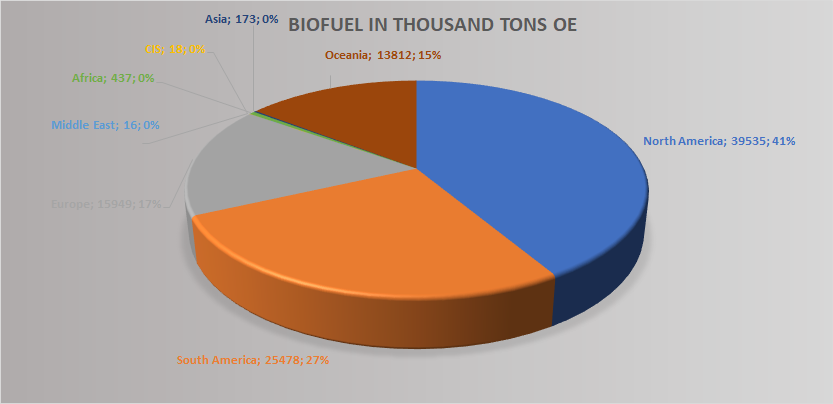

In North America and Europe, the use of biofuels has roughly doubled in the last 10 years, with biodiesel mainly being used in Europe and bioethanol in North America. South and Central America experienced the lowest growth, with around 50% growth in the same period. In the rest of the world, consumption has quadrupled. Given the trend towards a multipolar world, opportunities arise for many developing countries to differentiate between providers, which will limit the use of biomass.

Nuclear energy (4,5%)

Pure electricity generator and most climate-friendly method of generating energy. Even if 4.5% looks small, that is the proportion of total energy worldwide. If you look at the power generation of the industrialized nations, a different picture emerges. Front-runner France, for example, gets around 80% of its energy from nuclear power. Despite its bad reputation, nuclear power is part of the environmentally friendly generation of energy. There are no CO² or pollutant emissions. If all energy came from nuclear power, a person would produce 300 grams of nuclear waste in the course of his entire life. There are strong efforts to reduce the radioactivity of the waste product, which already mark significant successes. Energy production from twenty tons of uranium corresponds to that of 400,000 tons of coal. But due to the risk of accidents and their devastating effects, nuclear power will not enjoy renewed popularity. Researchers at the Max Planck Institute assume a core meltdown every ten to twenty years. The world's largest risk area is southwest Germany, due to the high density of nuclear reactors in the neighboring countries of France and Belgium. On average, around 34 million people in Asia would suffer from serious consequences for each core meltdown; in Europe, this figure is 28 million. In addition to the risk of a core meltdown, constantly occurring leaks and minor accidents are constant exposure to radiation and the reason for the increase in various diseases, such as thyroid problems or cancer. Unfortunately, there is no representative study on this.

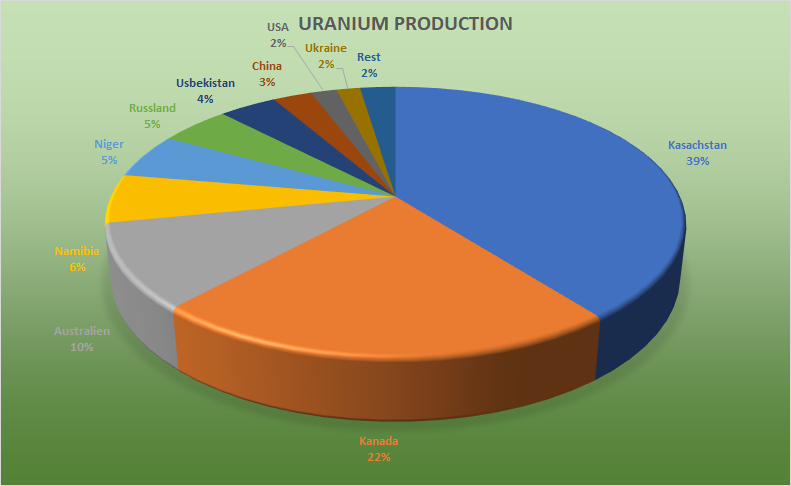

Around 60,000 tons of uranium were mined worldwide in 2018. Kazakhstan and Canada were responsible for two-thirds. The known uranium deposits in the world amount to almost 8,000,000 tons. With an annual consumption of 60,000 the uranium deposits will be sufficient for about 130 years with today's consumption.

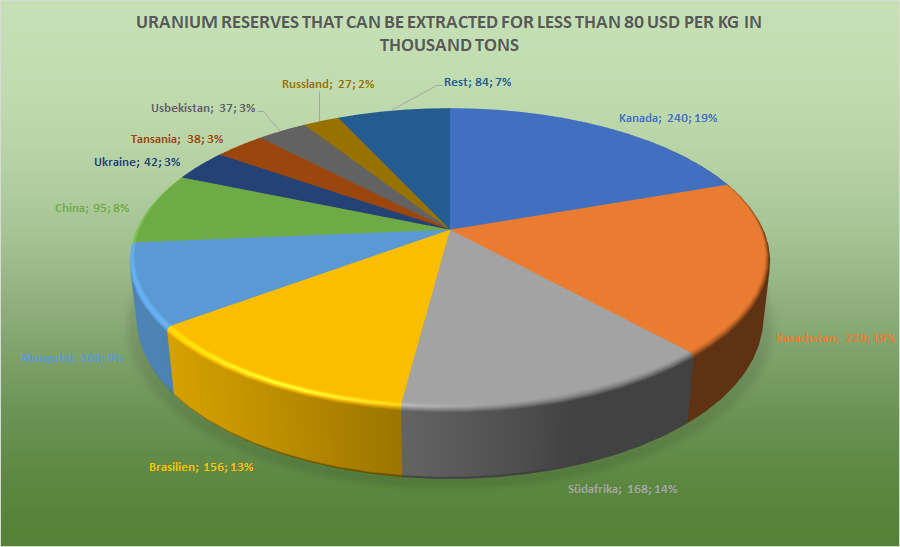

However, significant price differences must be taken into account when mining them. Uranium, which can be mined for less than 40 dollars per kilo, is just 650,000 tons, which means 10 years if used today. Reserves that can be mined for less than $ 80 per kg amount to 2,100,000 tons and would therefore be sufficient for 35 years. At $ 130 per kg, which corresponds to a reserve of 5.2 million tons, it becomes marginal for economic viability. Even if this corresponds to about 80 years, the costs for solar and wind energy will fall steadily over the next few decades, thus reducing uranium mining towards zero to the end of the century. In this context, there are nations with rich uranium reserves for less than $ 80 / kg, alongside Kazakhstan and Canada, as well as Brazil, China and South Africa and Mongolia.

In addition to uranium, there is another element that provides energy through decay, thorium. Thorium reactors or so-called liquid gas reactors are considered safer and as the nuclear energy of tomorrow. Since thorium is also roughly 3 times as abundant as uranium, the future of thorium is promising.

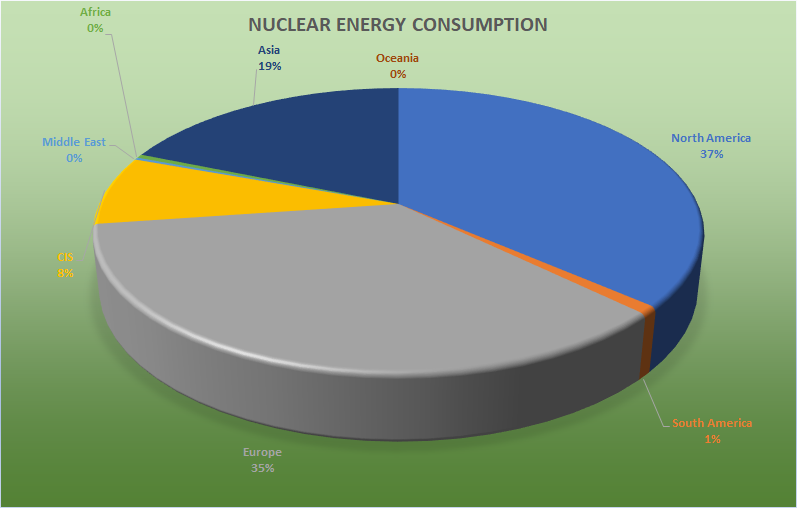

The US alone uses almost a third of nuclear energy. France, China and Russia a further third. Even if some nations like Germany are pulling out of nuclear power, 50 nuclear power plants are under construction and 146 new nuclear power plants are being planned worldwide. China, India, Russia, the USA and Great Britain make up the lion's share of this. The replacement of nuclear power plants depends heavily on the development of solar and wind systems.

There is another possibility to use nuclear energy that has not appeared in any equation so far and that is described by critics as a fantasy: Fusion energy! It is anything but science fiction. After the ISS, the ITER experimental fusion reactor in southern France is the most expensive human project. With a total of 35 nations, all major economic and military powers are involved in it. There are also other projects, such as the Wendelstein X-7, which may have fewer investments, but are also very promising. So far it has been possible to keep the reaction stable for 90 minutes and to extract energy. If a stable reaction rate were achieved, one fusion reactor would provide more energy than 10 nuclear reactors without the risk of core meltdown or radioactive waste. The elements that could be considered for a nuclear reactor are lithium (ITER and Wendelstein X-7 are based on this principle), helium-3, which is very rare on earth (the NASA and ESA have new ambitions to fly to the moon to mine this Element), or boron, for which there has been no relevant research. With its ambitious politics and with almost 70% of the global boron reserves, Turkey has a good opportunity to find international investors and partners for a project to use boron as a raw material for fusion energy. The waste products are harmless, like Helium in the case of boron. The development of nuclear fusion energy may revolutionize the energy market in the next few decades, or go down in history as the most costly failure.

Hydropower (2,5%)

Hydropower plants are pure electricity producers. The kinetic energy in the natural flow of water is converted into mechanical energy via turbines or wheels and into electrical energy via generators. 9 of the 10 largest power plants are operated with hydropower. The largest is the Three Gorges Dam in China, which with 22.5 GW delivers almost three times as much energy as the largest non-water-powered power plant. Even if hydropower has no harmful emissions, the lower oxygen content in the water is a problem due to the slower flow. In addition, the flooding of large areas takes away human and animal habitats. Above all, it disrupts the structure of the water course and represents a considerable interference with nature. Since the water would come to a standstill if it were exhausted, the use of hydropower plants is only possible to a limited extent. With around 3% of the electricity share in Germany, this limit is already quite close.

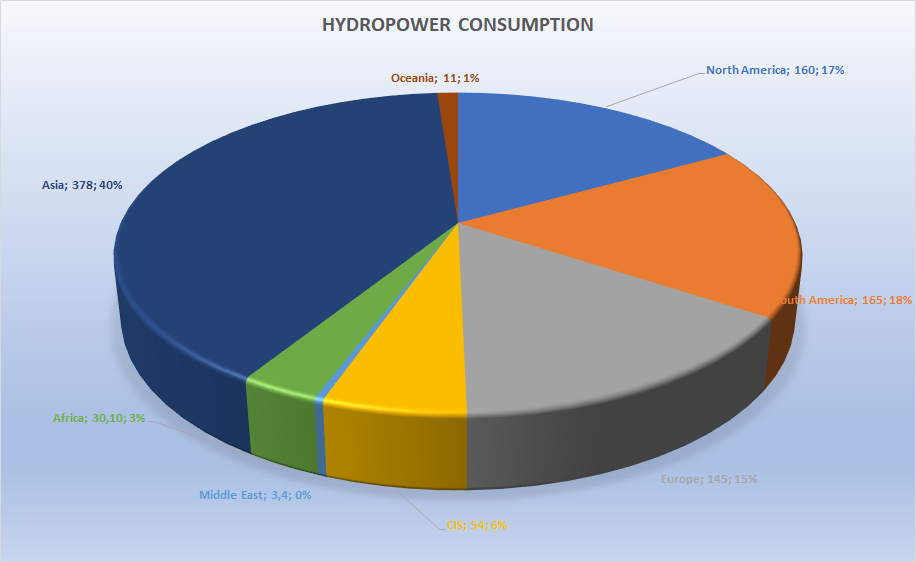

The importance of hydropower will therefore not experience much change in Germany. Globally, it is of much greater importance with 17% of electricity production. In percentage terms, Norway is the world champion with a 98% share in electricity production, followed by Brazil (85%), Venezuela 70% and Canada (61%). In terms of absolute numbers, China (652 Twh), Canada (370 Twh) and Brazil (363 Twh) have the lead. In the Figure above it is noticeable that South America competes with North America and Europe in terms of absolute consumption. Hydropower plays a particularly important role in South America because of its lush rivers. It is rarely found in the Middle East and Australia. In the CIS countries, especially Russia, it makes a significant contribution to the electricity budget with 18%. In many regions of the world, there is still significant potential for hydropower plants. However, climate change is clearly affecting hydropower. Due to the low rainfall in 2018, the energy yield from hydropower fell significantly, in Austria at times by up to 40%. In some regions, a reduction in yield of almost 50% is predicted by 2040. Worldwide, a 4% lower yield is assumed.

Wind energy < 1%

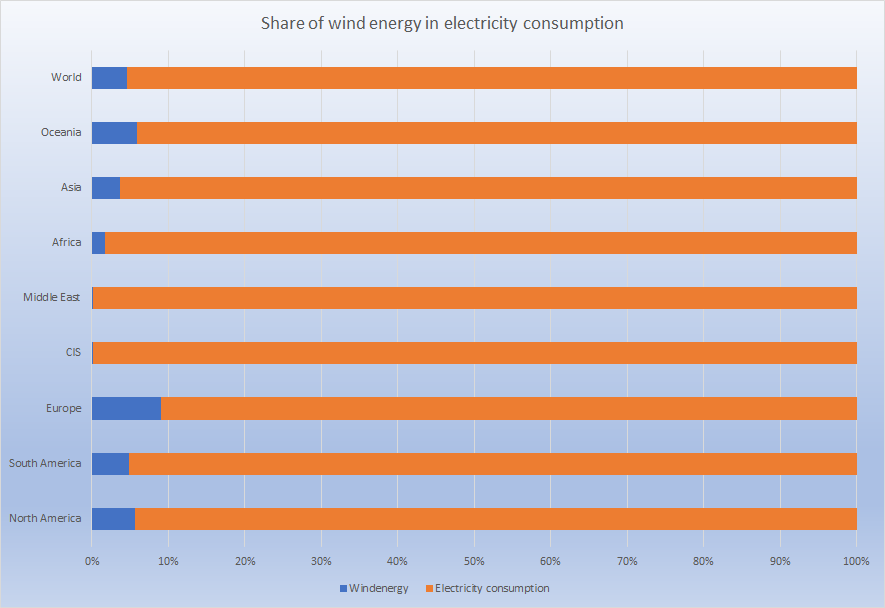

Wind turbines are only used to generate electricity. The energy that is in the wind is more than 100 times the global energy demand. Even if only a fraction of it can be used without impairing nature too much, it could cover the entire power supply in many regions. Together with solar energy, they are the superstar of renewable energy and the greatest bearer of hope for people and the environment. It is all the more surprising that their share of global energy consumption is at less than 1%. Measured by the electricity consumption of the respective region, Europe is the leader in terms of wind energy, followed by North America, Oceania and South Africa.

In Germany wind energy is very well represented with 21% of total electricity consumption. In terms of absolute numbers, as in any other form of energy, China is at the top. Brazil accounts for more than 70% of South America's wind energy use. In the Middle East and the CIS countries, wind energy plays almost no role at all. In Africa, it is South Africa, Morocco and Egypt, which account for 90% of the continent's wind energy use.

Wind energy does not cause any harmful emissions or CO² emissions during operation. The manufacture, transport and the establishment of such systems on the oter hand, are associated with pollutant emissions that are offset against the service life of such wind power systems. However, this in no way devalues the wind turbines, as it is the fault of other energy sources. This means, if the company producing wind turbines would get its electricity from wind energy and the vehicles for transport would have electric motors that would also get their electricity from wind energy, the wind energy would be completely emission-free.

The efficiency of wind energy depends very much on the location. According to Betz's law, the energy yield increases with the third power of the wind speed. That means eight times the energy is generated at twice the wind speed. The choice of the location is therefore very important. The power per area is not limited by the physical size of a wind turbine, but by its slipstream. After passing a wind turbine, the wind loses speed because it has given up part of its energy. According to researchers from the Max Planck Institute, a maximum of one watt per square meter can be obtained using wind energy. However, this is not so dramatic as the area between the wind turbines can be used for other purposes. In locations with good conditions for a wind turbine, electricity production is cheaper than with coal or gas power plants. However, since the provision of energy is subject to the weather, it is not suitable for a base load supply. Economic possibilities for storing energy could change this fact in the future.

Wind energy is the most widely represented energy source among renewable energies. This is probably also due to the fact that nations with higher energy requirements are mainly located in regions with less sun. However, the growing economies of many developing countries and technological advances give solar energy an advantage. However, both forms of energy will play a much more important role in the future than they do today.

Solar energy ( < 1%)

One day radiates a multiple of the energy on earth than the worldwide annual energy requirement. With a share of less than one percent of total energy consumption, there is still a lot of room for improvement. It is the form of energy among the renewable energies with the highest investments worldwide. Measured by its size, it is even the top of all energy sources in this discipline. There are many ways to use solar energy in a targeted manner. Solar collectors with excellent efficiency are used to convert solar energy into heat. Solar thermal power plants make greater use of this principle by reflecting the sun's rays onto a collector, so-called absorber, which transfers the resulting heat into a water reservoir and thus generates energy by generating steam. Another method is solar thermal power plants, in which the enclosed air is warmed up and discharged through a chimney due to the resulting natural convection. The air flows through a sensibly placed wind turbine and generates electricity.

Probably the most popular and innovative form of using solar energy are photovoltaic systems. Energy from sunlight is used to convert the electrons in semiconductors (e.g. silicon or gallium arsenide) into an electrical current. There is no other form of energy that, measured in terms of its share, has grown as strongly as photovoltaics.

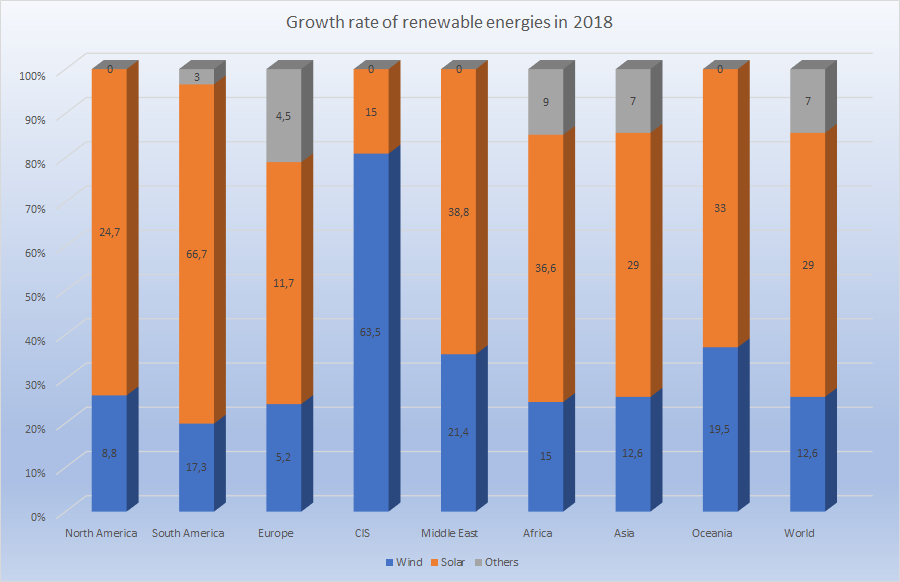

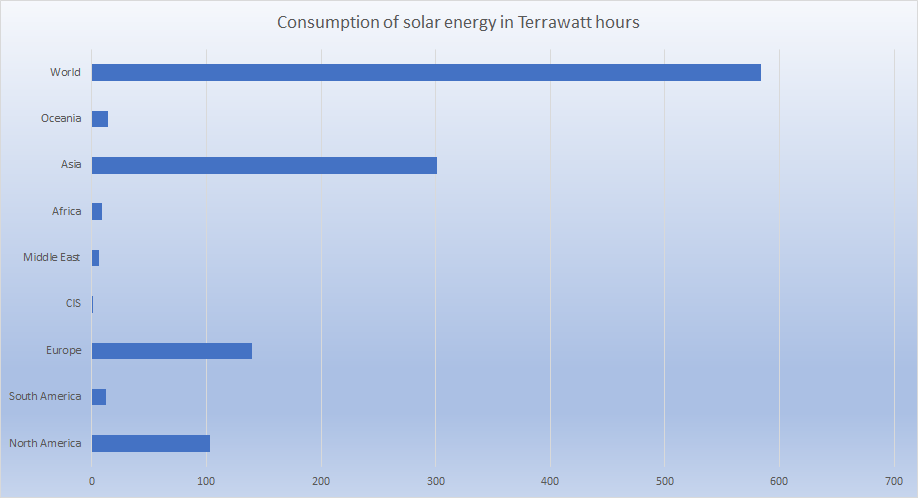

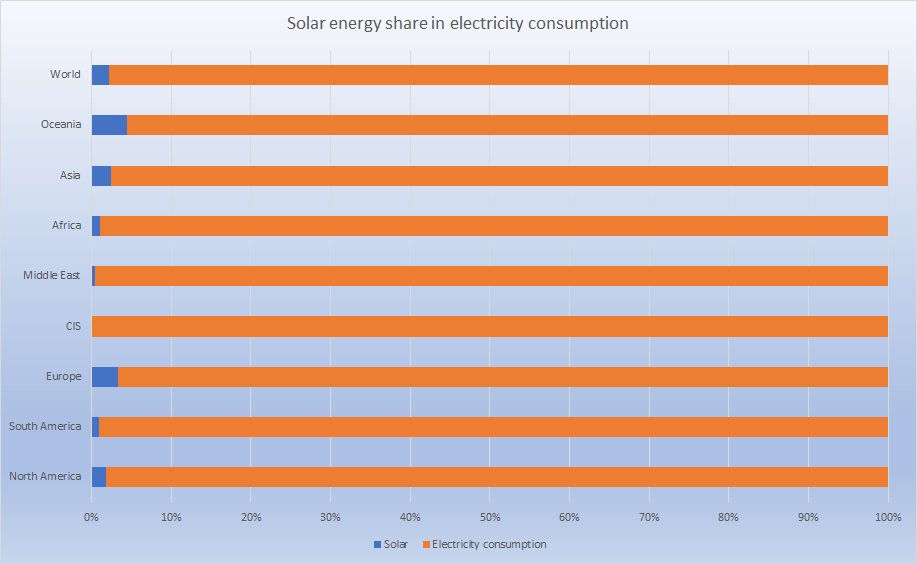

Worldwide it experienced a growth of 29% in 2018 compared to the previous year. Increased growth can be seen particularly in South America, the Middle East and Africa. Europe shows the lowest growth, followed by the CIS countries. Measured against the services already available, however, it shows that the lower percentages in Asia, North America and Europe are not due to a lack of investment, but rather to large capacities that are already available. Asia, especially China, shows remarkably high investments.

Only CIS states show little investment as well as low existing stocks. However, it becomes clear that the values are still very low for all regions of the world when one compares the share of solar energy with the total electricity consumption, which itself only accounts for 20% of the total energy consumption. So it is understandable that solar energy is experiencing the greatest growth in terms of its size.

Nations with the largest share of solar energy in electricity consumption are Japan with 7% and Germany with 6%, although these countries have a low solar constant. For sunny regions in the world, this form of energy generation is a clean and profitable alternative to fossil fuels. It is a welcomed support in colder latitudes but does not go beyond that, since the winter months with the highest consumption are also the poorest in the sun. The seasonal, but above all the daily fluctuations to which a photovoltaic system is subject, prevent solar power plants from taking on the role of base load supply. The development of storage technology for the possible uses of solar energy will play an important role.

In addition to the uneven production of energy over time, the low space efficiency is another disadvantage of photovoltaic systems. The largest photovoltaic system in the world in Tamil Nadu India has 648 MW on ten square kilometers, only a thirtieth of the space efficiency of the largest nuclear power plant in the world, Kashiwazaki Kariwa in Japan, which has an output of 8000 MW on four square kilometers. Nevertheless, the efficiency of the solar modules has increased significantly. For comparison: The second-largest solar power plant in the world, Topaz Solar Farm in California, supplies with 550MW on 19 square kilometers significantly less electric energy than the one in Tamil Nadu India with almost twice the size. Due to the high space requirement, the photovoltaic systems also compete with areas for growing food in some regions.

However, in sun-poor nations such as Germany, with a high population density that is relatively homogeneously distributed over the entire area, this is a significantly greater problem than nations that have large, unused areas available. This also applies to countries with a greater population density than Germany, but with very wide metropolitan areas. One example is Pakistan, which is more densely populated than Germany but has a density of less than 1 inhabitant per 1 km2 on a land area the size of Germany in Balochistan. Regions around the tropics often have similar characteristics.

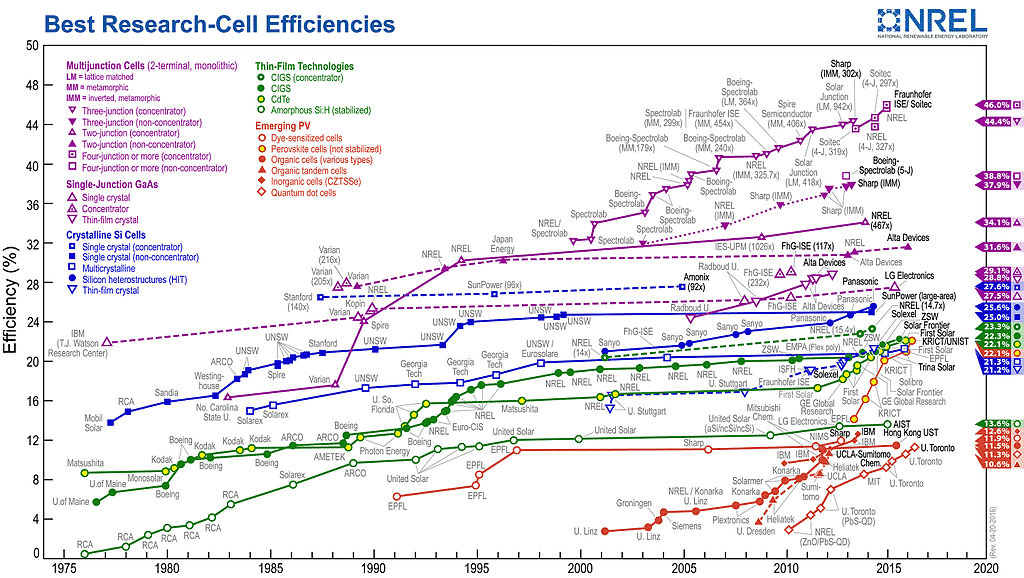

However, it must be taken into account that space efficiency is constantly increasing as technology advances. The purity and nature of the material play an important role. Nowadays, with the most expensive materials, an efficiency of 30% can be achieved. However, these solar cells are made from a combination of gallium and arsenide, both of which are very rare. While the arsenic is evenly distributed in the earth's regions, the previously known large gallium deposits are limited to a few places such as China, Kazakhstan, Ukraine and Germany. There are methods of making better use of the surface by applying several layers, so-called tandem solar cells. Efficiency levels of 46% have already been achieved. However, these are only worthwhile in strong sunlight.

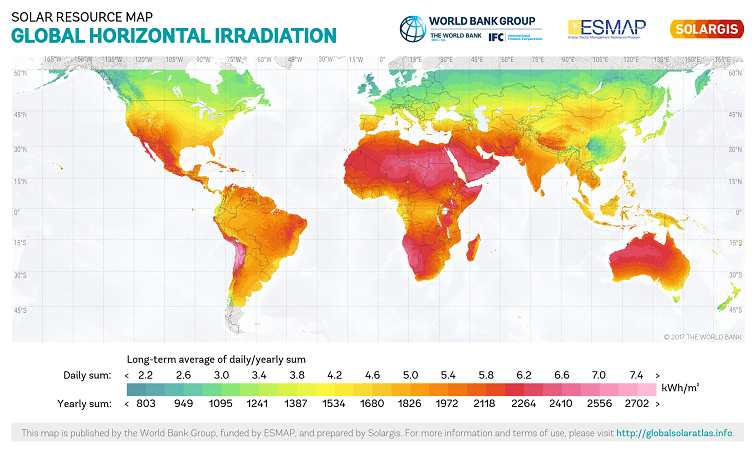

The figure on the right shows the solar radiation on the earth. All regions that are yellow, red or pink have enough solar energy to achieve the same output per area as coal-fired power plants with new, efficient solar cells. It can be seen that the vast majority of regions with strong solar power lie within the boundaries of developing countries. The use of solar energy will play a particularly important role for these countries in the future. A major disadvantage, however, is the lifespan of a solar cell of 25 years.

The increasing trend in renewable energies that offer cheap electricity is displacing more cost-intensive power plants such as gas and coal-fired power plants. This is the so-called merit order effect. According to BP, growth of over 400% is expected over the next few years. Up to 70% of the increased demand for electricity should be met by renewables, so that in 2040 they will cover 25% of the total electricity demand. That would put it in second place after coal. In the transport sector, it is 25% of the increase in demand. By 2040, 15% of the energy for transport should come from renewable sources.The main energy supplier in this sector will remain oil. In addition to the number of vehicles, the intensity of use is also important, for which there are various models for assessment, These models, however, have a large potential for deviation. Government interventions such as bans on the sale or use of internal combustion engines are other unknown variables that can pull the equation to one side or the other.

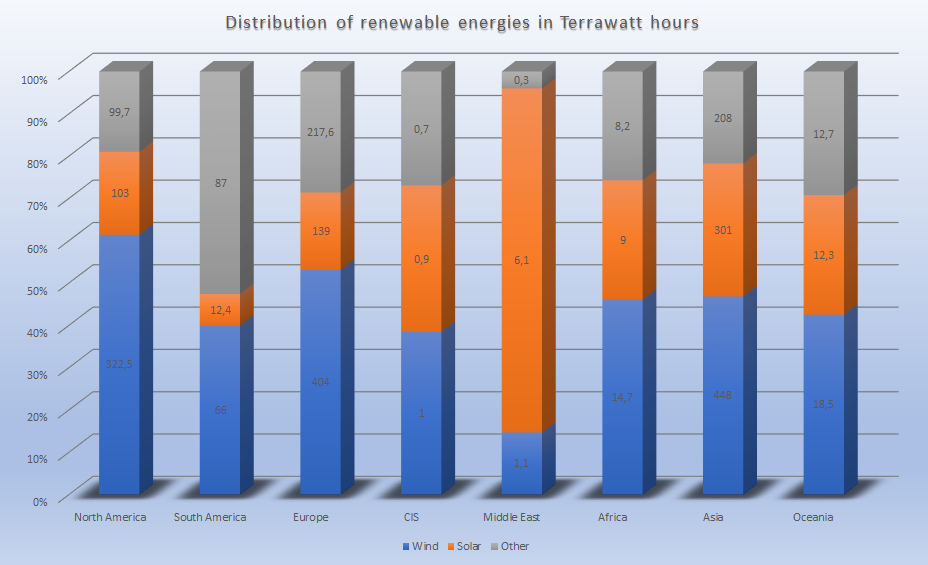

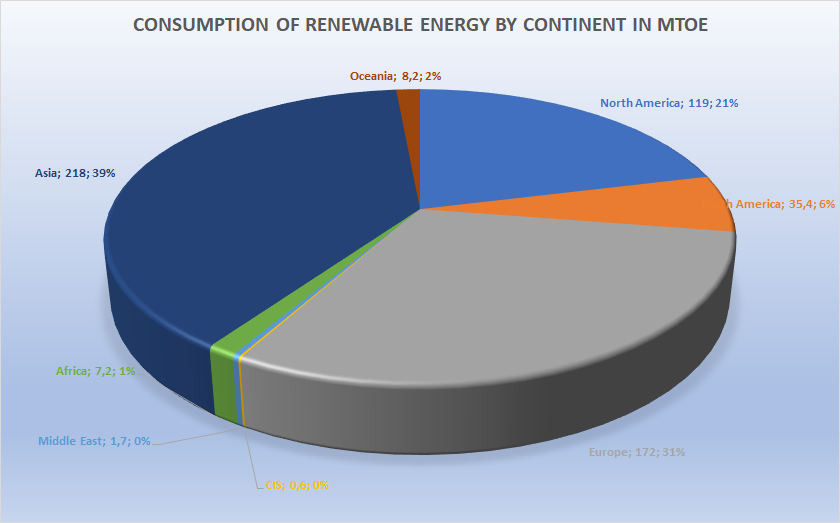

A holistic view of the use of renewable energies in the regions shows the large proportion of Europe and Asia. Taking into account the total energy consumption, Europe's share of 31% is significantly larger than that of North America. However, as in every other energy discipline, Asia is one step ahead. Given the investments, this will not change in the future. The very low proportion of CIS countries and the Middle East is also noticeable.

Electricity

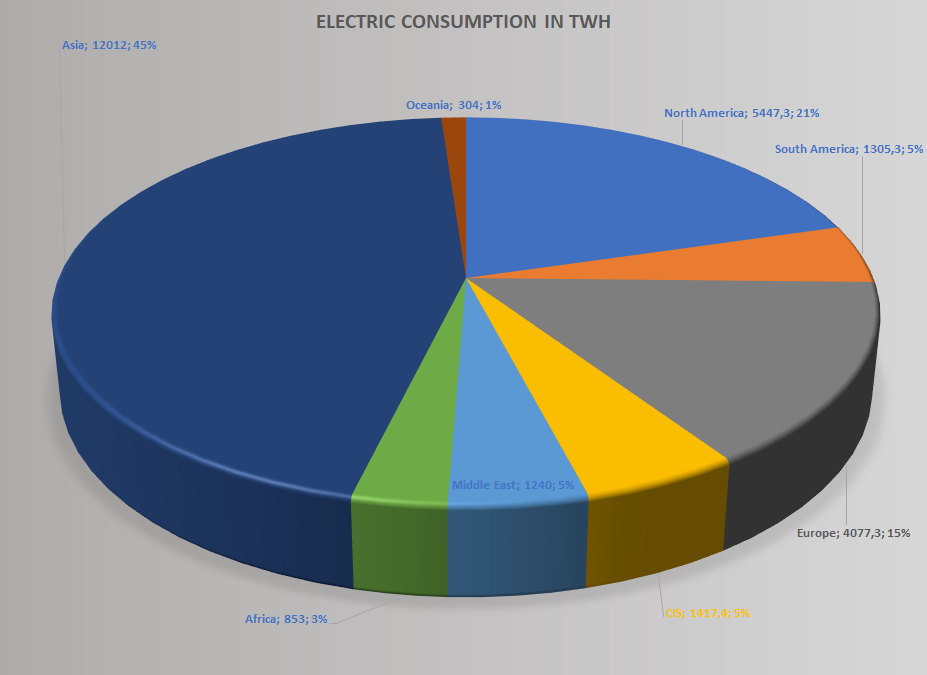

The largest CO² emitter in the world is power generation. Even in Germany, with a relatively high share of renewable energies in power generation, it remains the biggest climate offender. World electricity consumption is increasing continuously, although North America and Europe show little growth. Worldwide electricity consumption has increased on average just over 2% in the last 10 years. Asia holds the record with a growth of 5-6% per year.

The three regions mentioned consume over 80% of the world's electricity. Coal and gas make up the lion's share of global electricity production. The high proportion of coal is mainly indebted to China, India and the USA. The electricity consumers with the lowest consumption, Africa and South America, show large discrepancies among each other.

CIS states and the Middle East occupy the middle field. With a population almost three times as large, Africa consumes only two-thirds of the electricity from South America. So a South American consumes 4.5 times more electricity per capita than an African. Electricity prices are usually higher for residential areas and vary more in price than in industry. Electric cars, digitization and the phase-out of coal will allow electricity production to grow even faster in the coming decades. According to Bloomberg, wind and solar energy will account for 50% of electricity in 2050. In some regions even up to 80%. The greatest indeterminacy in this equation is the development in nuclear energy. Relatively safe molten salt reactors with little nuclear waste or absolutely safe fusion reactors without any radioactive waste would be the main electricity supplier in many places, provided the development is successful.

Greenhouse gases

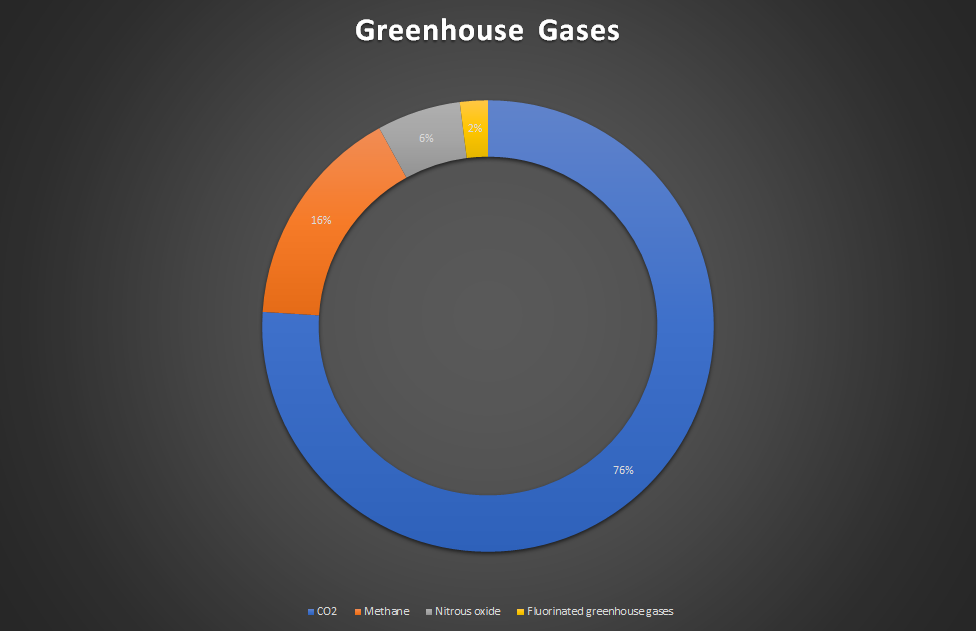

The largest greenhouse gas is water vapor, which evaporates from the surface of the water and is released into the atmosphere. It is responsible for raising the temperature by 33°C. However, this greenhouse effect is vital for mankind, as it makes the earth a habitable planet for humankind. The well-known equilibrium is disturbed by the additional greenhouse effect caused by humans. Carbon dioxide is mainly responsible for the "man-made" greenhouse effect.

Since organic tissue binds carbon, the combustion of organic matter, regardless of whether it is fossil or recent, causes carbon emissions. In contrast, the creation of organic matter absorbs carbon. One cubic meter of beech wood contains about 340 kg of carbon. The forest floor is also rich in carbon. The human body consists of 28% carbon and 56% oxygen. This means that 84% of the human body consists of the largest greenhouse gas in exactly the right ratio: 1 carbon and 2 oxygen! But there are also other gases that contribute to the man-made greenhouse effect: methane, nitrous oxide and fluorinated gases together make up about a quarter.

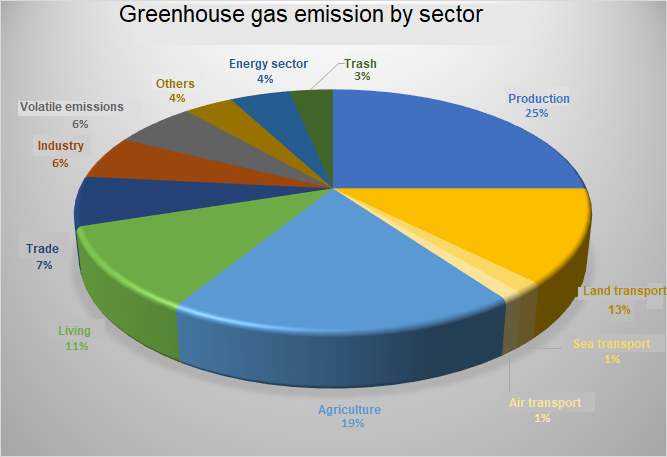

The largest emitter of greenhouse gases is the production sector with 25%. This partly explains the fact that Germany, as the European production-champion, emits twice as much greenhouse gases as the second occupation. Together with agriculture (19%) and the transport sector (16%), these three sectors are responsible for 60% of emissions. The same sectors are also those with the greatest potential for CO² reduction. In fourth and fifth places are the emissions caused by living spaces (11%) and trade (7%). Even if smart homes have a very good carbon footprint, it will take decades for only 10% of the population to live in them. No reduction is to be expected in trade either, as more and more deliveries are being used due to digitization.

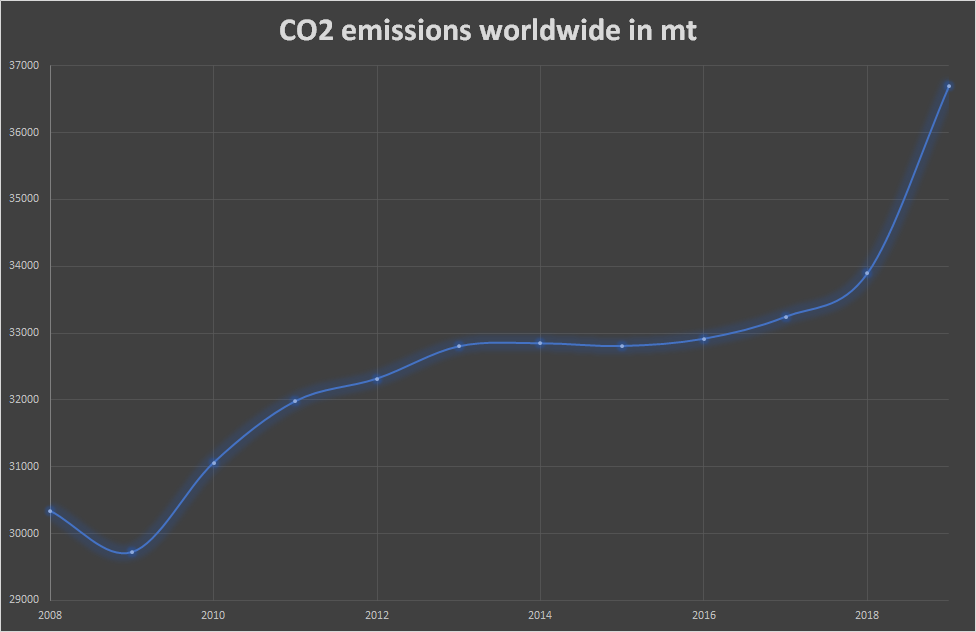

CO² emissions increased by 10% between 2008 and 2018. The rise after the fall during the 2008 financial crisis lasted until the Harbin smog incident in China in 2013. No relevant growth was noted until 2016. Interestingly, this is the year of the second major smog disaster in China, but with a much smaller impact. In the following two years, greenhouse gas emissions increased as much as in the past five. But 2019 broke all records and recorded as much growth in just one year as in the previous eleven years. In the same year, Germany posted the largest decline since the 2008 financial crisis.

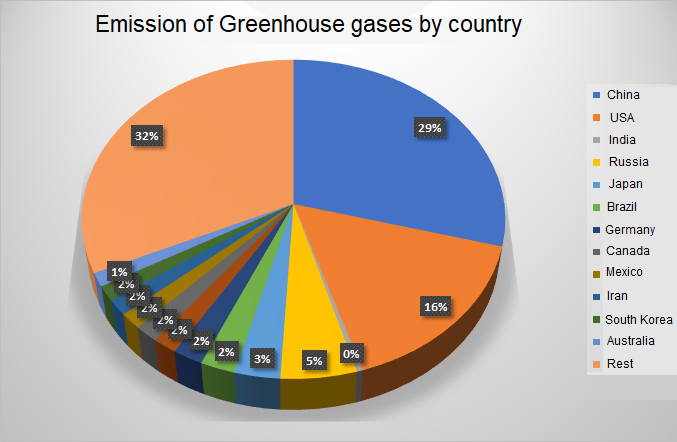

China, USA, India and Russia emit more than half of the world's CO² emissions. It should be noted that Russia has significantly reduced its CO² emissions over the past thirty years. The USA is the only country that was among the top emitters in 1990 and has grown steadily since then. Germany reduced its CO² emissions by 28% in the same period. The exponential increase since 2016 shows that the world is still a long way from achieving its climate goals of a maximum temperature increase of 2 degrees till 2100. Those who neither cause these emissions nor benefit from them will be punished. The emission of greenhouse gases is the price for the luxury and prosperity of the industrialized nations. The poorest 140 nations cause just 1% of greenhouse emissions. But it is they who will be hardest hit by global warming.

In the following, 118 nations are listed in order of their greenhouse gas emissions, all of which together account for less than 0.5% of greenhouse gas emissions worldwide: Ireland, Serbia, Equador, Hungary, Bulgaria, Singapore, Denmark, Switzerland, Sweden, Zambia, Central African Republic, Bolivia , Norway, Cuba, Afghanistan, Slovakia, Democratic Republic of the Congo, Mongolia, Sri Lanka, Paraguay, Nepal, Tunisia, Yemen, Uruguay, Bahrain, Uganda, Dominican Republic, Ivory Coast, Ghana, Jordan, Mali, Bosnia, Chad, Mozambique, Zimbabwe , Cambodia, Lebanon, Guatemala, Niger, Madagascar, Trinidad and Tobago, Senegal, Burkina Faso, Croatia, Estonia, Honduras, Equatorial Guinea, Lithuania, Brunei, Slovenia, Panama, Guinea, Papua New Guinea, Kyrgyzstan, Georgia, Nicaragua, Costa Rica, Botswana, Latvia, Benin, Macedonia, El Salvador, Laos, Moldova, Luxembourg, Namibia, Mauritania, Tajikistan, Malawi, Belize, Jamaica, Armenia, Albainen, Haiti, Gambia, Gabon, Republic of the Congo, South Z ypres, Sierra Leone, Eritrea, Rwanda, Togo, Mauritius, Lesotho, Guyana, Barbados, Bahamas, Montenegro, Suriname, Burundi, Malta, Islan, Eswatini, Fiji, Liberia, Grenada, Guinea-Bissau, Bhutan, Djibouti, Maldives, Sain Lucia, Antigua and Barbuda, Seychelles, Vanuatu, Cap Verde, Solomon Islands, Samoa, Sain Kitts and Nevis, Tonga, Comoros, Palau, Saint Vincent and Grenadines, Dominica, Sao Tome and Principe, Cook Islands. Nuiu, Kiribati, Nauru.

These nations collectively have the same population as those of the USA, EU, Russia and Australia combined, but cause only one-hundredth of greenhouse gas emissions.

Particulate matter

In parallel to the emission of greenhouse gases, there are also emitted gases that have harmful effects on the human organism. Fine dust particles are particularly important in this context. The rule is: the finer the parts, the deeper they penetrate the lungs. The PM standard (Particulate Matter) is used internationally. Depending on their size, they are divided into PM10, PM2.5 and PM1 (also called ultra-fine dust). The numbers in the index stand for the aerodynamic diameter in micrometers. Even if it is difficult to differentiate due to the nature of the matter, it is assumed that 10 million people worldwide die from fine dust pollution annually.

According to the researchers, fewer fine dust particles in the atmosphere due to the lower use of fossil fuels and the associated increase in sea surface temperature also ensure that more water would evaporate from the oceans, which would lead to more rain, especially in drought-plagued regions. The effect is particularly pronounced in monsoon areas and could improve food security and water access for people in parts of Africa, Central America, China and India. The scientists believe that phasing out fossil fuel burning would not only protect the climate in the medium term but also offer a great opportunity to significantly improve the health of people around the world.

Energy storage and natural resources

The storage of energy is gaining in importance with the increase in energy generation methods that are subject to daily fluctuations (such as wind and solar energy), the spread of electric cars and digitization. For a holistic picture on the subject of energy, one must also take a look at energy storage.

The most effective way to store electrical energy is in the form of lithium batteries. Other forms of batteries with lead, zinc or similar have significant disadvantages compared to the lithium battery. For this reason, the energy storage systems of all commercial e-vehicles are based on lithium. Nowadays a charged e-car with over 1000 kg can drive up to 400 km. In addition to the energy sector, lithium deposits are also of considerable importance for the computer, telecommunications and automotive markets. A Tesla electric car contains 60 kg of lithium while a smartphone contains only one gram. The telecommunication industry has a clear advantage in terms of price. An electric car is sold for around €80,000, the smartphones from the same amount of lithium for tens of millions. If there is a shortage of reserves, the e-vehicle will inevitably lose the price war for lithium.

Another important components of modern batteries are cobalt, graphite, nickel, aluminum, copper and manganese. The limiting factor in the production of lithium batteries are the global metal deposits. Since aluminum, copper and manganese are abundant in the earth's crust, the occurrences and extraction of lithium, cobalt, graphite and nickel represent a more important variable, which will be analyzed in the following, starting with lithium.

Lithium

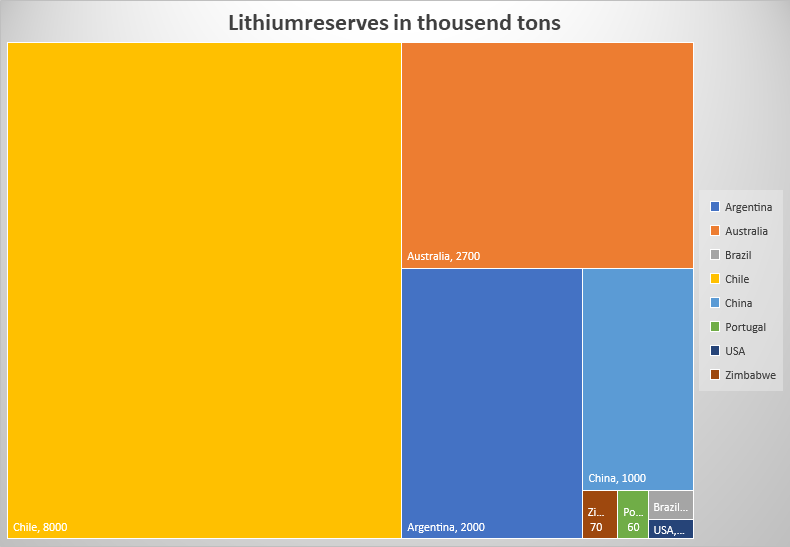

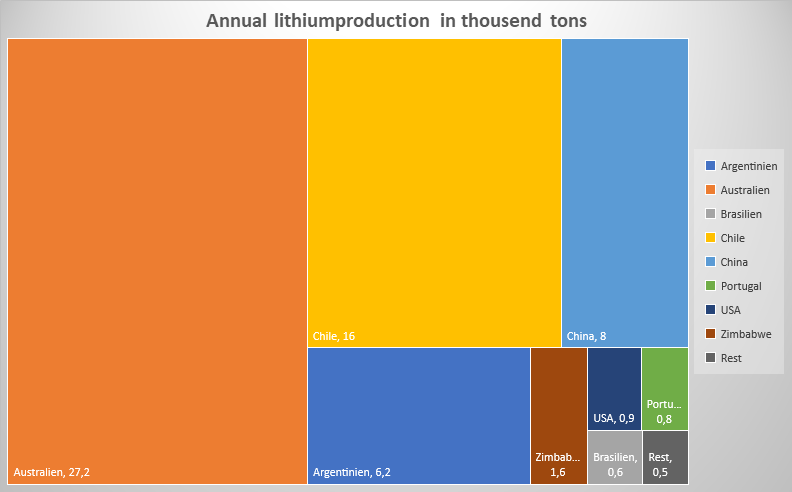

The lithium price quadrupled between 2015 and 2017 and then fell as a result of an oversupply. Above all, the increased production in Australia, which displaced Chile from the top, has been depressing the price of lithium for years. However, the price has not fallen to the level before 2015, as many had suspected. 60,000 tons of lithium are mined annually. Australia and Chile account for over 60% of the production. The proven lithium deposits of over 16 million tons (occurrences in Bolivia under the Salar de Uyuni are not included, since no exact figures are available yet) will last for centuries at this production rate. However, lithium cannot easily be mined in the short term. The production of usable lithium of 99% purity requires large facilities and a lot of time since the lithium extracted has a purity of around one percent.

Geologists estimate that there are 47 million tons of lithium reserves worldwide. Very large lithium deposits are suspected in Bolivia, which even exceeds those in Chile. Some even speak of twenty million tons. In future political events around Bolivia, this aspect should not be neglected in analyzes.

The problem of many industrial nations in the current situation is that almost the entire offer has already been bought up. Chinese companies hold the lion's share. States that do not have their hat in play currently have great difficulty getting their foot in the door. The Bolivian government recently stopped a contract for joint lithium mining with Germany, which was essential for the German automotive industry.

Even if the reserves appear abundant relative to today's production, the steep increase in lithium demand in the battery cell industry will be very difficult to satisfy. With 60 kg of lithium carbonate per car (this number varies depending on the car), which corresponds to around 12 kg of lithium, around 1.5 million cars can be produced with the reserves known today. There are over a billion cars with internal combustion engines worldwide (estimates are around 1.5 billion). The replacement of all cars with internal combustion engines by electric cars, given today's technology, can neither be achieved with proven nor assumed reserves. Especially since other elements also have a limiting effect on the possible number of e-cars, such as cobalt.

Cobalt

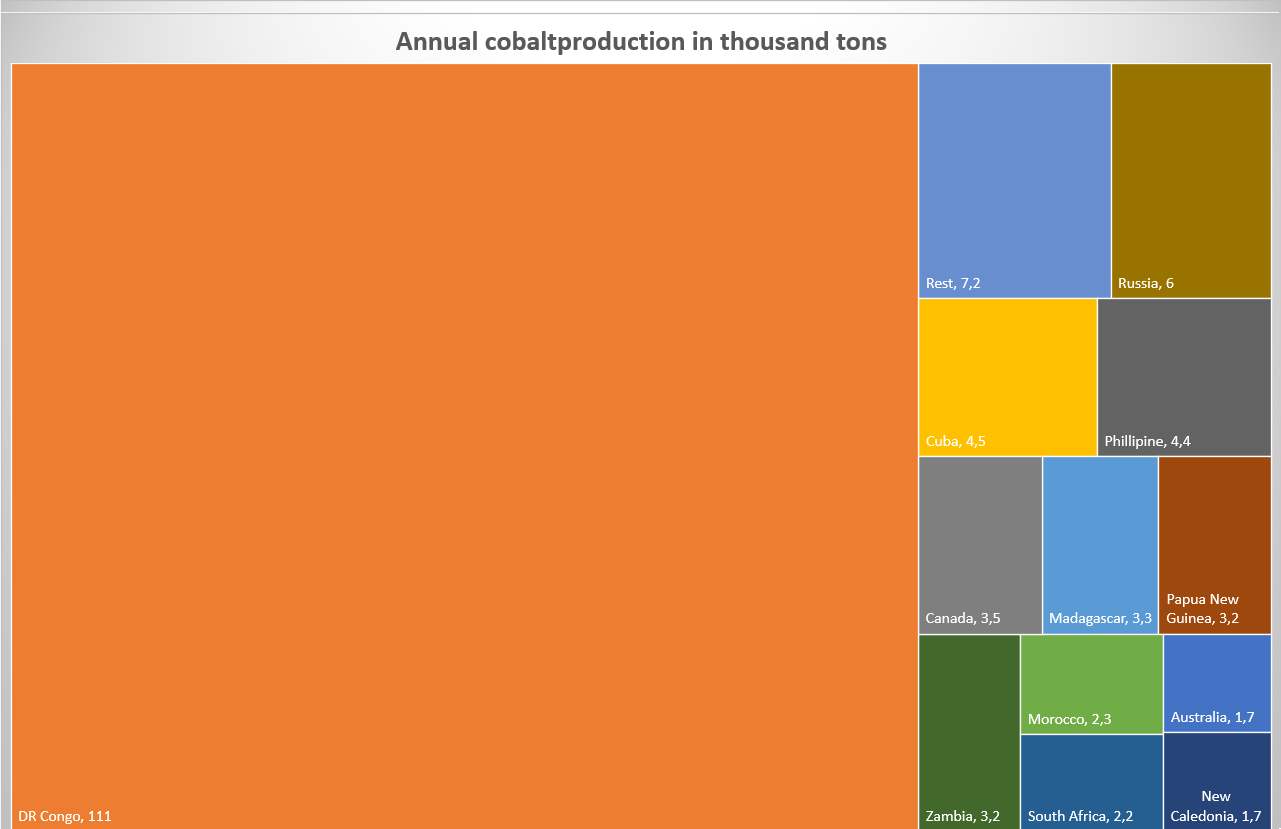

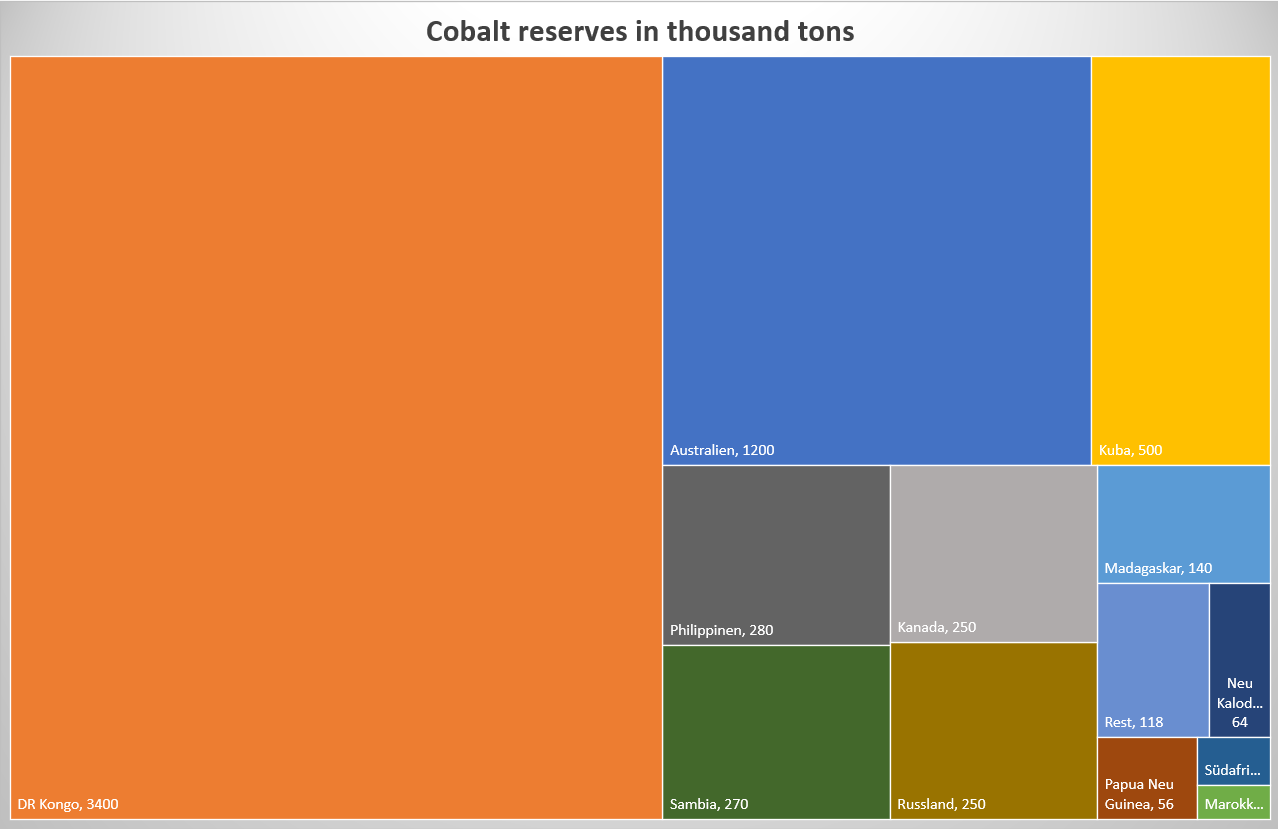

The amounts of cobalt and lithium in a car battery are comparable, even if the use of cobalt is subject to strong fluctuations depending on the company (cobalt content: Tesla 2.8%, VW 14%). Although cobalt is a rare element on earth, reserves won't be the real problem in the near future. Since cobalt has so far been used very little for other purposes, it will take time to find and extract larger amounts.

The demand for cobalt has so far been filled by the mines of the Democratic Republic of the Congo, which has led to countless small wars and the complete destabilization of the country for decades. For the coming increase in demand, the production in the Congo will not be sufficient and the production of electric cars will be in direct correlation with the discovery of new reserves. This dependency can only be broken by the possibility of producing lithium batteries without the use of cobalt, which, unlike lithium, appears possible.

The largest sources of cobalt are believed to be on the bottom of the three largest oceans. For most of the already recoverable sources, the same applies as for the known lithium sources: Most of them have already been bought up. Once again, China has the lion's share. Political rivalries that may arise from the demand for graphite will likely become apparent in disputes over the maritime law.

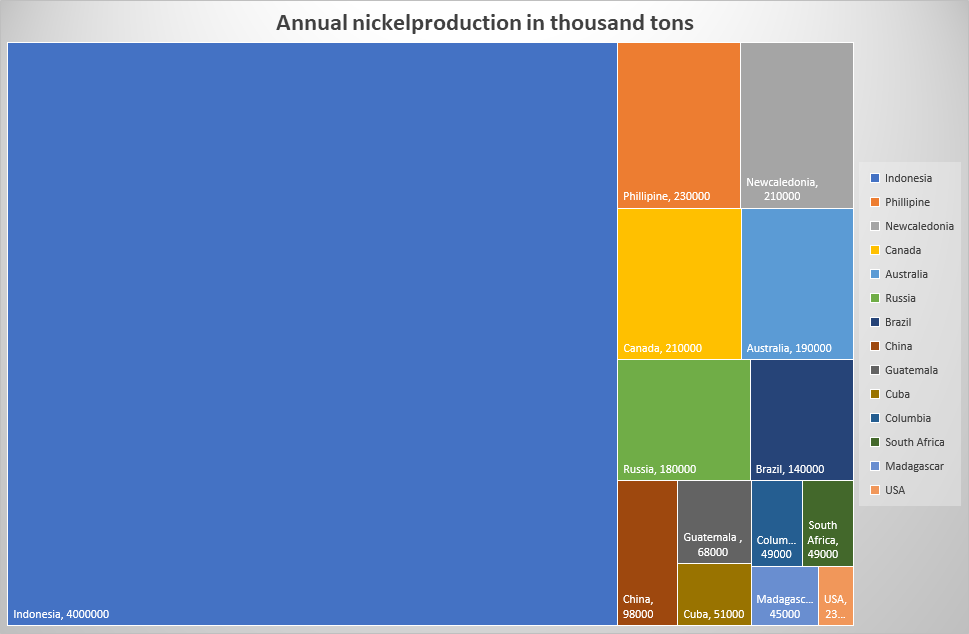

Nickel

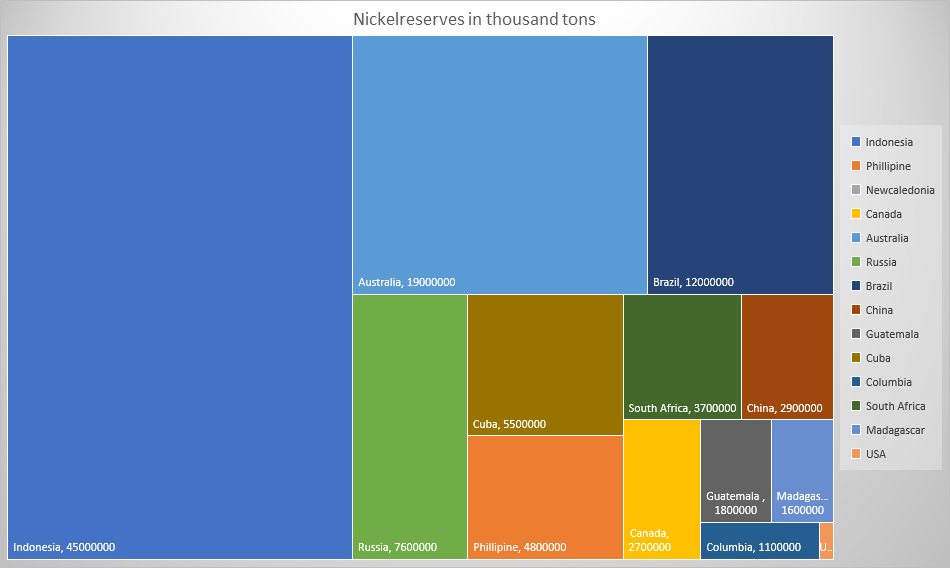

Nickel is a fairly rare element, accounting for 0.008% of the earth's crust. More than 70% of the nickel extracted comes from Indonesia and is an important part of the national economy. With regard to cobalt-free lithium batteries, nickel plays a major role, because large quantities of nickel are required for such batteries. Secondary suppliers for nickel are in order of their share the Philippines, New Caledonia, Australia, Canada and Russia. The first three places are mainly Chinese companies that are responsible for nickel mining, above all the market leader Tsinghan. The reserves are more evenly distributed than the production. There are no major discrepancies, as in the oil industry. Only Russia and Brazil have a bigger share in production than their respective share of the reserves. Australia on the other hand, has a lower share in production than it has in reserves. The Indo-pacific area seems to be the worlds nickel storage.

Graphit

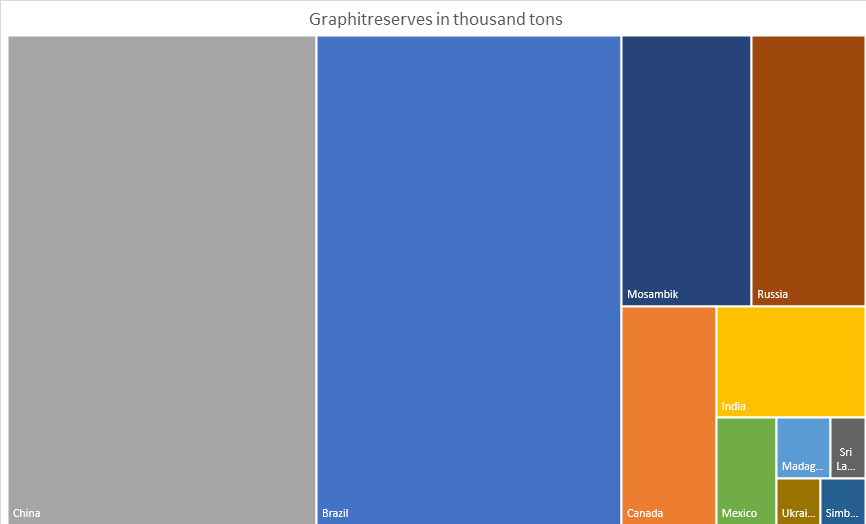

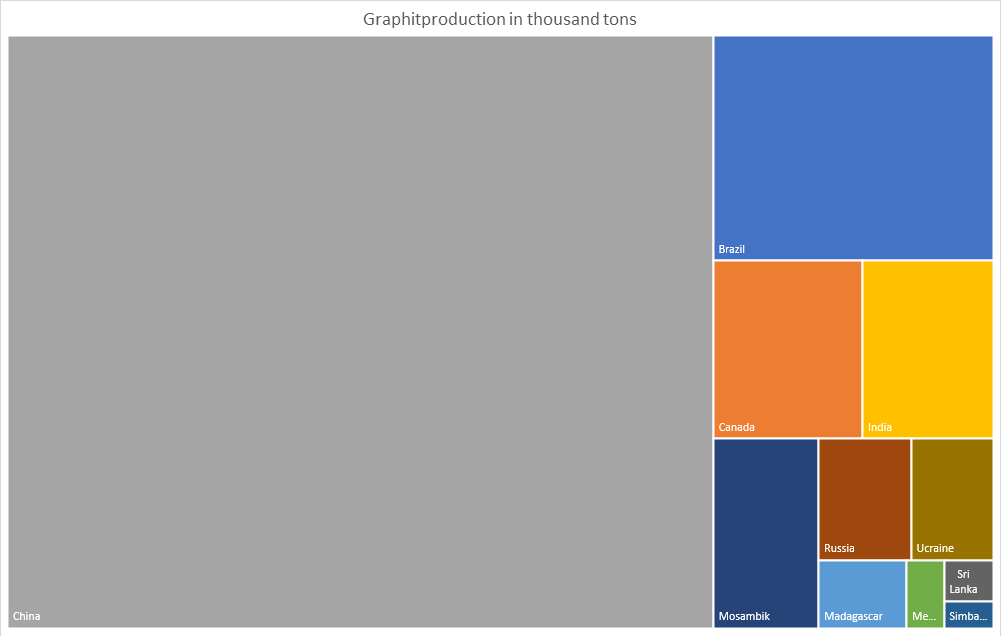

Graphite is a very common element. However, as in most other mineral resources, the distribution is concentrated in a few countries. The importance of graphite lies not only in its use in lithium batteries but also in the possibility of being an independent carrier of so-called graphite batteries.

Since it takes up more space, it is out of the question for smartphones and laptops, but could become lucrative for the automotive industry, especially due to the price war with the telecommunication industry. As of today, over 70% of the graphite used worldwide comes from China. Brazil produces less than a quarter of China, with almost the same reserves.

The dependency to a battery without lithium is very high in countries with a big automotive sector but no access to lithium reserves, like Germany and France. To the detriment of these nations, China seems again to be the winner in this discipline. The relationship between Brazil and European countries can play an important role in this matter.

There is already a large number of researches on the storage of electrical energy by means of various elements. A very productive concept is an approach with sodium and silicon, which, however, only has a very short lifespan. The Max Planck Institute for Colloids and Interfaces in Potsdam is working on batteries with vanilla. Developing a successful concept with a long lifespan would reshuffle the cards on the market for energy storage and its fringes.

However, if one considers the current production quantities and the production potential of cobalt and lithium and the international trend towards e-cars, it is possible to assume that the e-car market will grow to a few hundred million cars in the next ten years. BP estimates that by 2030 15% of all vehicles (around 300 million) will be electric cars, which cover 30% of the total distance traveled. The ban on the sale of new internal combustion engines from 2030, which nations such as Germany, India or Norway have stipulated, or from 2040 such as Great Britain and France, or similar ambitious goals for almost all major economies, make this development appear realistic. Of course, the automotive industry has also adapted to these goals. Tesla, General Motors, Chevrolet, Ford, VW Group, BMW, Daimler, Toyota, Honda, Nissan, Peugeot, Renault, Volvo, Hyundai and 170 Chinese car manufacturers have set themselves various very ambitious goals for the period 2020-2030. Competition with the telecommunications industry, as well as other technological developments, will determine the future in this matter.

Mineral oil company ➛ Energy company

As representatives of the largest energy supplier, the largest energy companies in the world are oil and gas companies. There are two ways for them: sticking to their product or restructuring from a pure oil company to an energy company. Both ways have their justification and the most profitable way is different for each company. Oil will undoubtedly remain one of the largest suppliers of energy for the next few decades. For companies with large oil reserves, holding onto oil is certainly an economically sensible option. The environmental awareness of the population of nations in which the oil companies are based certainly also plays a role. As an example of this, the Guardian recently issued a statement that they will no longer accept advertisements from oil companies. Investing in renewable energies makes sense, for oil companies in many ways. Since energy from renewable sources is still very weakly represented but has a very large growth potential that it will necessarily exploit, investments in this sector are promising. In fact, since it is an area that will penetrate the oil company niche and supplant their main business, it is essential. Another advantage is the possibility of influencing a development that will undo your own main business.

As the largest mineral oil company, Aramco founded the Saudi Aramco Energy Venture in 2012 with the aim of reducing CO² emissions worldwide. By 2019, they have invested $500 million in 45 companies that aim to do just that. The success of these companies sparked Aramco's appetite, with the largest IPO in history taking place in December 2019. Aramcoo has listed 1.5% on the domestic stock exchange for $ 25.6 billion, which it plans to invest in renewable energy investments. That the state company did not go to the London or New York stock exchange shows the national ambitions of the country. The goals under the name Saudi Vision 2030, as well as the founding of the CO²-free and completely self-sufficient mega-metropolis Neom certainly contributed a lot to this decision. The wide range of know-how and technologies required for such an undertaking sheds light on the wide range of investments made by Aramco.

Membrane ventilation technologies through kerfless wafer technology (epitaxially grown wafer-thin disks). Since oil production is the main source of income, its extraction is of course also affected by this progress. A fully automated oil production system that is operated entirely with solar energy is already installed in Wa’ad Al-Shamal. The second-largest oil company in the world, Rosneft, shows little commitment to renewable energies. They pursue the strategy of lowering CO2 emissions by other means, such as increasing the efficiency in the use of fossil fuels. (Update: on February 17, 2020, Rosneft made a statement that it will invest 5 billion euros in renewable energies over the next 5 years. National Iranian Oil Company does not make any relevant investments in renewables. China National Petroleum and PetroChina together have the largest share of renewable energies among oil companies.

Exxon Mobile, the largest privately-owned oil company, is very reluctant to talk about renewable energy. It is only known for the ambition to want to produce a million barrels of biofuel from algae by 2025.

As early as 1980, BP made significant sums in renewable energies such as solar and wind energy. In 2001, BP renamed itself from British Petroleum to Beyond Petroleum, thus setting a sign that they don't want to be a pure oil company, but an energy company. Since then, BP has made many investments in this area. Recently, BP bought 47% of the largest solar energy developer. Furthermore, BP has made major investments in battery groups and companies that are active in the expansion of a charging infrastructure.

Shell's investments go even further. In addition to investments in power supply, charging stations, solar and wind energy, Shell is also investing significant sums in the development of fuel cells as Propulsion for vehicles. Shell spent two billion US-dollars in 2016. A year later, Shell bought the largest charging company in Europe. Further investments in solar energy followed in 2018 in the USA and India.

The French oil company Total decided to invest 3% of its total capital (currently that is 500 million US-dollars) annually in "clean energy" and to increase this to 20% by 2040. Intending to become the global leader in solar energy, Total invested 1.4 billion US-dollars in 2011 for a 60% stake in a solar energy company (Sunpower) in the USA. They bought the French battery company, Saft, for 1.1 billion US-dollars and the Belgian clean energy company Lampiris for 224 million US-dollars. Last year the company bought 74% of a French energy supplier, Direct Energie, intending to make it the main supplier of France.

The Italian oil company Eni is also following the trend towards renewable energies. Only American oil companies Exxon and Chevron are not making any relevant investments in renewable energy. These are also those private oil companies with the largest proven oil reserves. Since fracking is expensive, oil production in the USA costs significantly more (between 25-70 dollars) than in the OPEC countries (less than 10 dollars). For most US oil-producers, mining is only worthwhile at a price of around $50 per barrel. Falling demand for oil is therefore threatening the very existence of US oil production.

When the oil price fell below $50 dollars for several months in 2015 and even reached a short-term low of under $30, a wave of bankruptcies went through the USA with 150 bankruptcies, 150 billion debts threatened both the oil producers and the banks. It must be taken into account that an unused oil well can result in high costs. In addition to the taxes that many countries charge for unused sources, there are other costs. If they are not closed, the oil and gas come to the surface. Contaminated soils and gas explosions can drive up costs very quickly. Many states have a compulsory subsidy anyway. So quitting the production do not decrease but increase the costs. Therefore, an oil producer cannot temporarily cease production when prices are low, but must keep producing to generate income so that it can at least cover some costs. In such an uncertain situation, banks will not share the risk with the oil producers. Since fracking sources are very short, these companies are also forced to open up new fields, which in turn is associated with costs that they simply cannot bear with low oil prices.

Among the main oil producers, Russia is best armed against falling oil prices. According to the law, only the profit up to a limit of 42 dollars is spent on the state budget. Any amounts above will benefit the National Wealth Fund. It looks more critical in the Middle East, since the incomes depends heavily on oil. But even if Saudi Arabia and other OPEC countries show a clear budget deficit with low oil prices, years with low oil prices would have to pass before there is a risk of national bankruptcy.

Since the USA with its aggressive fracking policy has a strong influence on the oil policy of nations whose national budgets depend on oil and gas exports, it is not unlikely that OPEC and Russia will join forces against the American fracking industry, which seems to have already started, disguised as an argument. For the US, however, the fracking industry is essential to achieve its stated goal of being completely self-sufficient in the energy sector. It is impossible to predict in advance which registers will be used in this game and which political consequences this will have for everyone, given the almost unlimited possibilities.

While some companies' insistence on the oil business will keep demand going for a period of time, there is only one exit for oil. Thus for companies that make little investment in alternatives, there are three possible strategies:

1. They don't invest at all, and towards the end of the century, they take their hats off and leave.

2. They delay their investments until they can no longer control the rate of oil displacement, and then step in on a large scale when the business has become even more profitable with better technology.

3. In order not to bear the sins of the past as a hump, they cut the connection to the company's history and reinvent themselves.

Conclusion and forecast

A decrease in the energy demand is not present in any model in the distant future. First of all, the growth of demographics and economies of developing countries accelerates the need for energy. The share of renewable energies, especially solar and wind energy, will grow rapidly. Its role in electricity supply will be more important than in transport. Oil will be displaced by gas to second place between 2035 and 2045. Increasing efficiency of one of the main oil consumers, industry, through digitization reduces the need for oil and gas. The share of oil as a raw material for the petrochemical industry will grow significantly. The oil demand will peak between 2030 and 2040.

Natural gas will continue to increase over the periods under review until 2050 as it serves as the main substitute for coal. Unlike oil, its main consumer is not the transport sector, whose trend towards electric propulsions, due to their immense power requirements, prevents electricity from competing for gas in its main consumers, industry and households. Similar to crude oil, however, natural gas has that the demand for petrochemicals is growing steeply. The gas reserves are larger and therefore more durable than those of petroleum. In 2040, gas is very likely to be the world's main energy carrier. For coal, it is predicted that the main consumer, China, will not experience any further increase. The downward trend after 2013 will show up again in a few years. It should be noted that a percentage decrease does not mean an absolute decrease. According to various forecasts, the absolute decline will take place between 2030 and 2040. The search for soil estimates for storage will cause tension in many countries espacially in South America, but it will also contribute to the development of some nations.